You are certain you have what it takes to implement your idea because there is a sizable market for it.

However, persuading investors on your product’s potential and skill set can be intimidating. That is where the investor pitch deck comes into play.

A deck is a presentation that companies use to give investors an overview of their business. The deck typically contains slides with information about the company’s product or service, business model, team, market opportunity, and financials.

Decks are essential because they can be used to persuade investors to invest in a startup. That’s why they should be well-designed and well-researched to convince investors in funding your idea.

If you’re thinking about pitching investors on a new idea or business venture, this article will help guide you through the process.

Hi there. I’m Viktor, a pitch deck expert, presentation expert and a creative strategist. My work has helped my clients win millions worth of pitches and helped 100+ companies develop decks that are currently helping them raise investments and close deals.

The guide below provides tips on creating a successful deck, including examples and templates. It’s designed to help you make an impressive pitch deck for your investors, making sure that you come up with the best pitch, even if this is your first pitch deck ever.

Book a free personalized pitch deck consultation and save over 20 hours of your time.

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

- What Is an Investor Pitch Deck?

- What Is The Purpose of an Investor Pitch Deck?

- What Are the Key Slides In An Investor Pitch Deck?

- Elevator Pitch Slide | An overview of your business concept and how it solves a problem or meets a need.

- Current Market Slide | The market opportunity slide and why now is the time to enter it.

- Go-To-Market Slide | Your target customers and how you plan to reach them.

- Competitors Slide | The competitive landscape and why you have a competitive advantage.

- Business Model Slide | Your business model and how it works.

- Team Slide | Your management team and their relevant experience

- Financials Slide | Your financial projections for the next 3-5 years

- Ask Slide | How much money you are seeking and what you will use it for

- The Risks Slide | The risks and challenges associated with your business and how you plan to mitigate them

- Thank you slide | A call to action for the investor to get involved

- What Else Should You Include In Your Investor Pitch Deck?

- An Investor Pitch Deck Structure You Can Steal And Not Say THANK YOU

- Title Slide:

- Slide 1: The Problem

- Slide 2: The Solution

- Slide 3: Market Opportunity

- Slide 4: Business Model

- Slide 5: Traction and Milestones

- Slide 6: Marketing and Sales Strategy

- Slide 7: Competitive Landscape

- Slide 8: Management Team

- Slide 9: Financial Projections

- Slide 10: Funding Request and Use of Funds

- Slide 11: Exit Strategy

- Slide 12: Thank You and Contact Information

- Important Do's and Don'ts

- What nobody will tell you: Crucial considerations to keep in mind when developing your investor pitch deck and business

- Understanding Investor Mindset in Pitch Deck Creation

- Effective Storytelling Techniques in Pitch Deck Creation

- Data Visualization and Design Principles in Pitch Deck Creation

- Market Analysis and Validation in Pitch Deck Creation

- Financial Modeling and Projections in Pitch Deck Creation

- Pitch Deck Structure and Flow

- Incorporating Technology and Innovation in Your Pitch Deck

- Addressing Competition and USP (Unique Selling Proposition) in Your Pitch Deck

- Legal and Ethical Considerations in Your Pitch Deck

- Success Stories and Case Studies in Your Pitch Deck

- Post-Pitch Strategy in Your Pitch Deck

- How to creatively pitch your investor startup pitch deck?

- Best Investor Pitch Deck Examples

- Best Templates

- Your Copy Of My Personal Pitch Deck Template

- Owners Also Ask:

- Final Words

- More Resources For You

What Is an Investor Pitch Deck?

A pitch deck for investors is a presentation that entrepreneurs use to raise funding from venture capitalists and other investors. Sometimes it’s referred to as a series a pitch deck, series b pitch deck, or even series c pitch deck – depending on the round you’re raising.

The deck is a presentation that tells the story of your business/company, such as its mission, highlights your team and product or service, as well as the market size, and outlines your financials and strategy for increased traction.

The presentation should also detail how you plan to do fundraising from the investors. This is important because it explains how you plan to use the money and what your goals are for the investment.

The deck needs to work as a way for investors to get more information about the company, its founders, and the value proposition of their business. Assume you’re looking to raise money from friends and family. In that case, this is often enough – but if you raise money from private investors, they will require more information than just a description of your products or services. That’s why you should really take into consideration the investors thinking.

Investors are curious about fresh concepts and businesses because they want to profit from their investments. They want to know if there is adequate profit potential so they can decide wisely when investing their money in a business or idea. When it’s time to decide whether or not to invest money in something new and intriguing, an deck is a key component that allows people to learn more about what a company does and how it plans to use its resources.

What Is The Purpose of an Investor Pitch Deck?

The investor pitch deck has multiple purposes. But its main goal is to make the company and its business plan more comprehensible and appealing to investors. Investors might use this information to decide whether or not to invest in the business.

Investors also use this information to decide how much money they will give to the startup to get a return on their investment.

That is why your deck also needs to show the potential investors why you’re an excellent fit for their fund and what your skills and expertise mean. In addition, it should provide a quick overview of your background so that they can get a sense of who you are and what makes you unique.

Shortly, pitch decks work as a tool to help investors understand your business, and the purpose of a pitch deck for investors is to:

- Explain the business’s goals and mission

- Describe how you plan on achieving those goals

- Explain the value you bring as an entrepreneur or company owner

What Are the Key Slides In An Investor Pitch Deck?

Assuming you have a great business idea, the next step is to start putting together your deck slides, which can be done through many available tools and templates on Canva, SlidesGo and Google Slides. But what exactly should you include in your slides?

Here are 10 key pitch deck elements when it comes to preparing a pitch deck for investors:

Elevator Pitch Slide | An overview of your business concept and how it solves a problem or meets a need.

The beginning of your pitch deck for investors should ensure that your business concept is well-explained and straightforward to understand. In this slide, you should describe how your service or product addresses a need or resolves an issue.

Example: “My business idea is a smartphone app that boosts productivity and organization for busy people. The users will be able to keep their tasks, calendar events, and notes in the app in a single location that is simple to access from their phones. The tool will also provide notifications and reminders to keep the users on track. This will be a great app for individuals constantly on the go and struggling with organization and commitment management.”

Elevator pitch slide example used for a client:

Current Market Slide | The market opportunity slide and why now is the time to enter it.

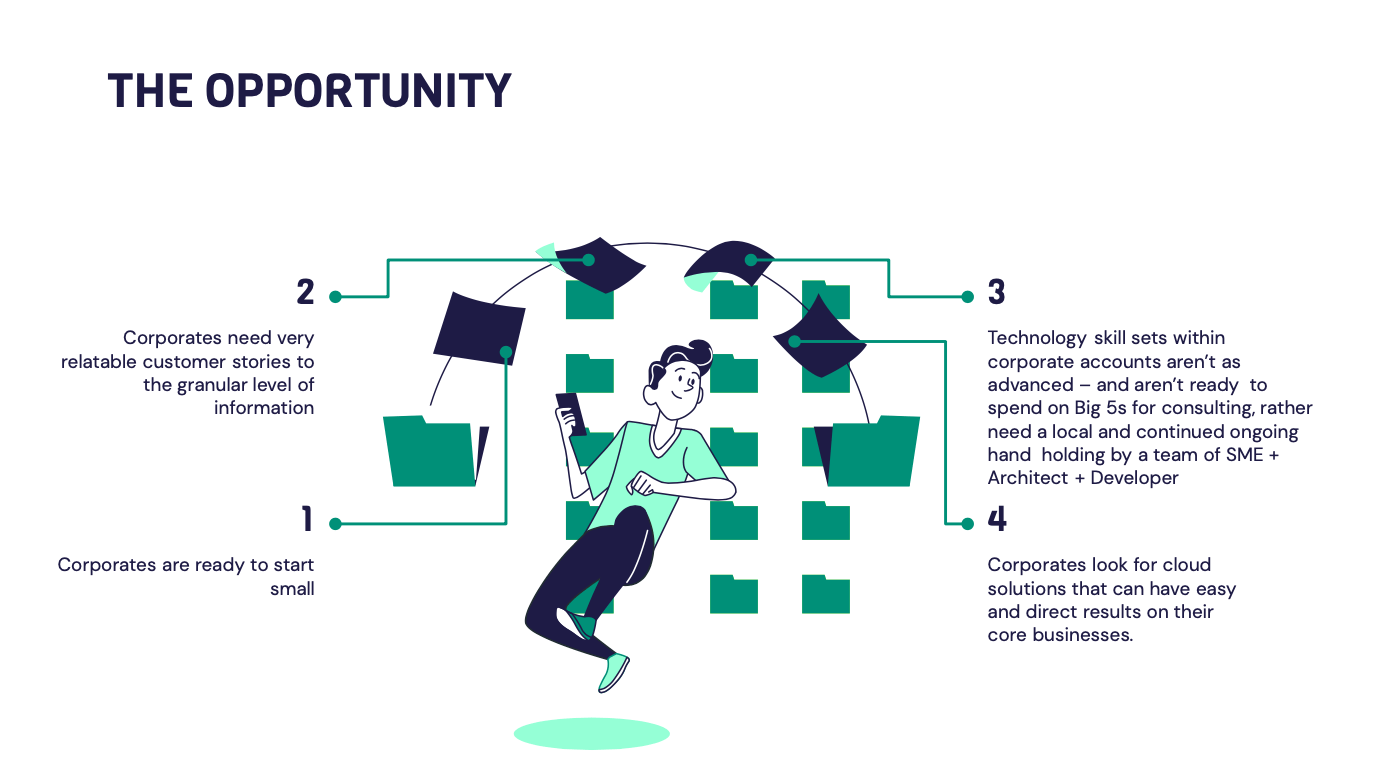

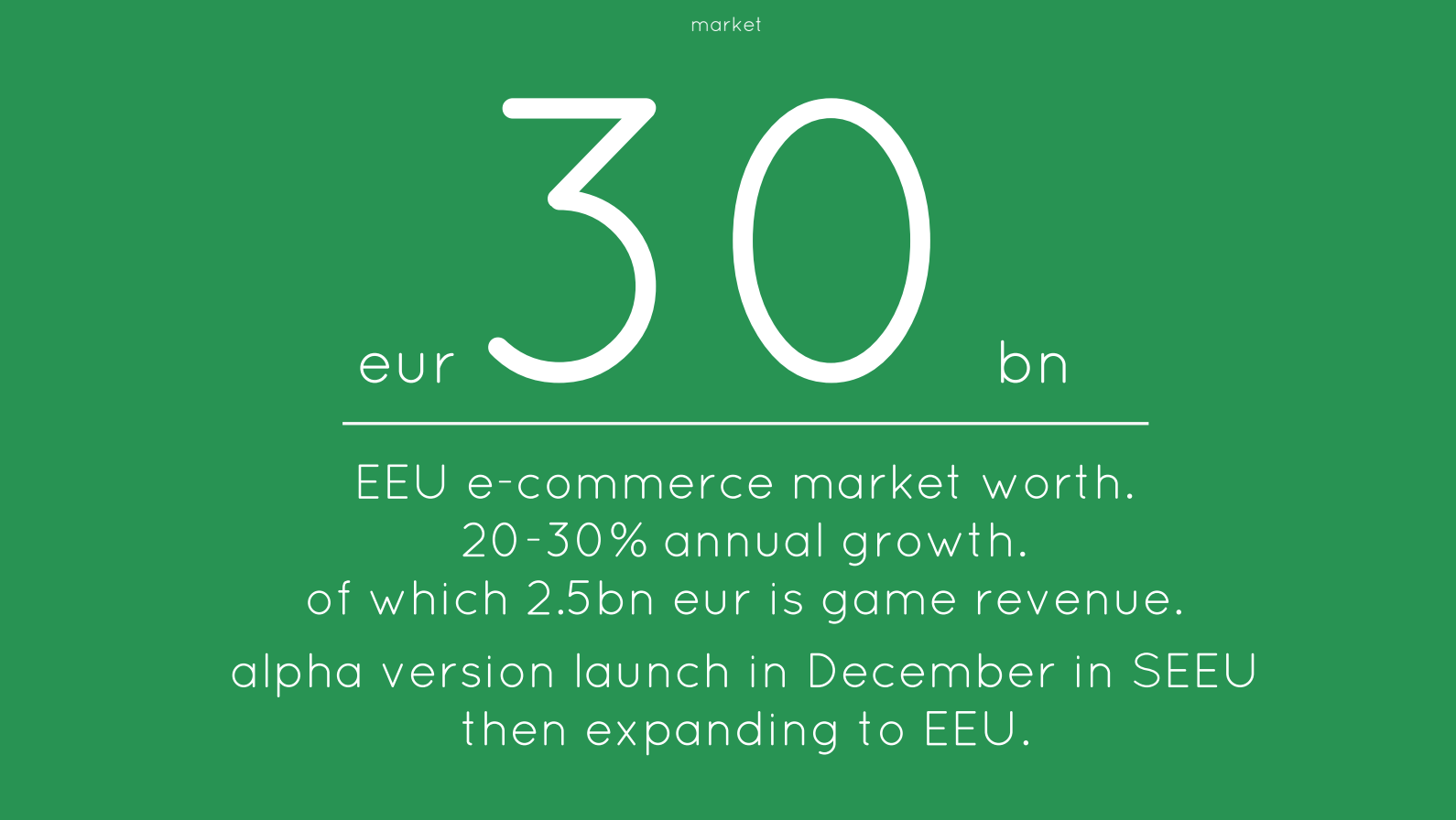

In this part of your deck, you want to explain to investors the market opportunity that is in front of you and why it is now the time to enter the market.

Example: This is because the market is growing, and there is a lot of potential for growth. The market is also becoming more competitive as new competitors are entering. To benefit from the opportunity, it is crucial to be in the market right now.

Market opportunity slide example used for a client:

Go-To-Market Slide | Your target customers and how you plan to reach them.

You want to keep your pitch deck focused on your target customers/market. In this section of your investor pitch, you want to ensure that your deck shows and demonstrates that you have a strategy for reaching them in the most efficient manner.

Go-to-Market slide example used for a client:

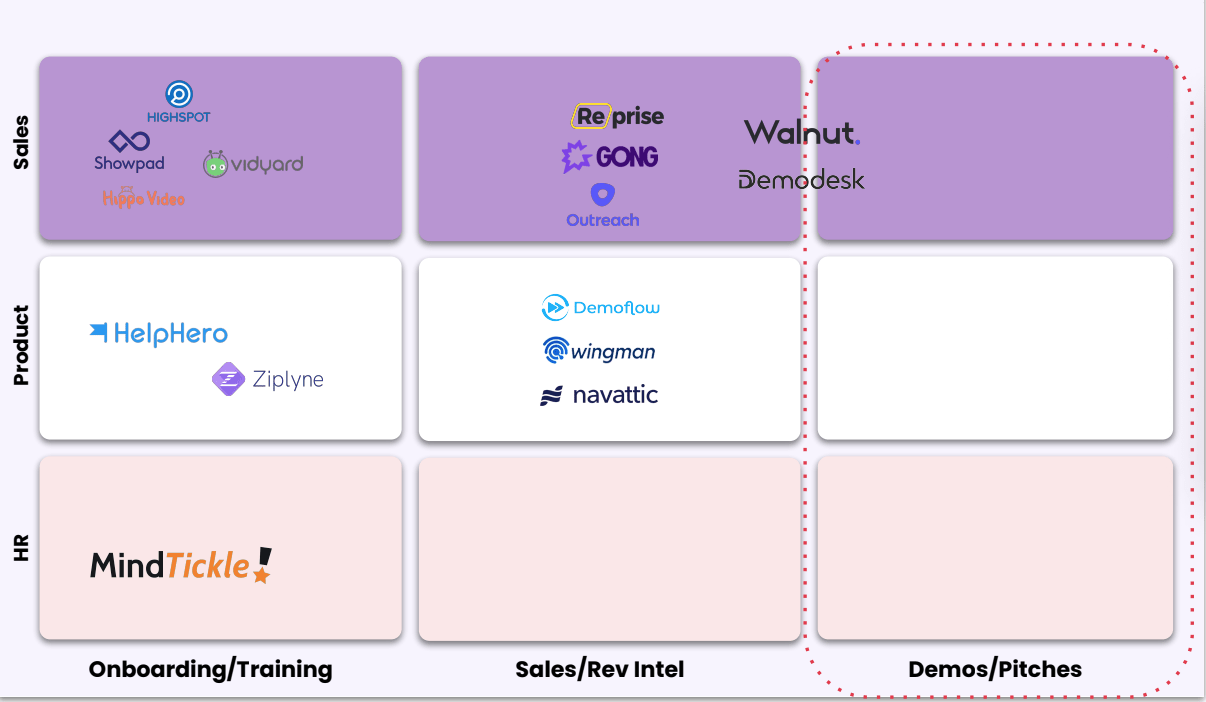

Competitors Slide | The competitive landscape and why you have a competitive advantage.

If you want your pitch deck to be effective, you need to include all relevant information about your competitors and how you uniquely differ from them. This slide should explain the competition you will be facing in the market and why you have a competitive edge. Without this information, investors will not be able to understand your business or see the potential for growth.

Competitor slide example used for a client:

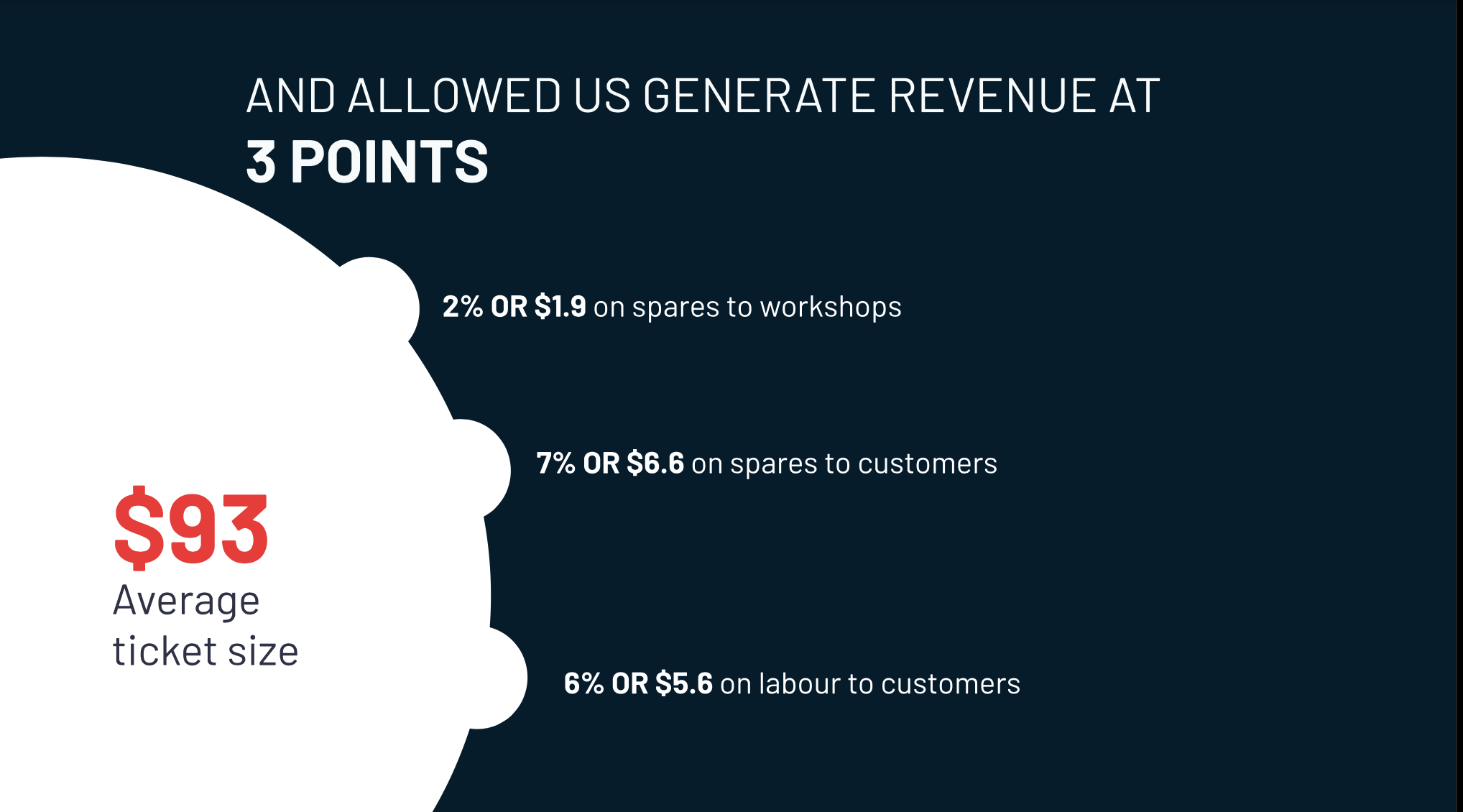

Business Model Slide | Your business model and how it works.

A company’s business model determines how it will generate revenue and make a profit. Companies need to consider their industry, target market, unique value proposition, and financial goals to choose a suitable business model.

So make sure you give a brief explanation of your business model and how it works by explaining the key points of your business model.

Business model slide example used for a client:

Team Slide | Your management team and their relevant experience

Investors will want to see and know it all. Starting with the people who will be responsible for the pace of the direction in which their money is going. So make sure you present them with your team and their experience in the relevant field.

Show them that they have a proven track record in successfully leading and executing projects: “The team has a wealth of knowledge and experience in the areas of this business. They are also familiar with the industry’s latest trends and developments, allowing them to make informed decisions about our organization’s future.”

Team slide example used for a client:

Financials Slide | Your financial projections for the next 3-5 years

A business plan is only as good as its assumptions. So make sure your deck includes the key metrics on financial projections for the next 3-5 years. This will give investors a clear idea of your expected growth and help them understand the risks involved in investing in your company.

Ask Slide | How much money you are seeking and what you will use it for

Since the deck aims to secure funding from investors, it is essential to include information that will convince them to invest in your company. This includes data on your company’s financials, your target market, and your competitive landscape. You should also include a detailed explanation of your business model and how you plan to generate revenue.

Investors will want to know how much money you want to invest in your product or service and how much they can make from investing in your company.

Privacy policy prevents me to share any sensitive info here.

The Risks Slide | The risks and challenges associated with your business and how you plan to mitigate them

We are all aware that there are always risks and challenges associated with any business. Investors will want to know the risk and challenge your business might face as soon as possible. So make sure you know most of the challenges you might encounter and develop ideas and strategies for dealing with them.

Risks and challenges are always associated with any business, and your business will be no different. Plan how to mitigate these risks and challenges by doing your homework and planning ahead as much as possible. You should show them that you are a person that can make sure to have the team in place and that you can rely on them to help you navigate through any challenges that may arise.

Thank you slide | A call to action for the investor to get involved

In the end, feel free to openly invite them to be part of your business and tell them why now is the time to get involved with investing in your company. Also, make sure to show them that there are plenty of opportunities to make a return on their investment. Get in touch with your financial advisor, see what options are available, and present them all.

Call to action slide example used for a client:

What Else Should You Include In Your Investor Pitch Deck?

In order to create a great pitch deck that will convince investors that they should invest in your business, you need to include the following:

- An executive summary (the first section) that outlines what problems your business solves and why they need solving

- A business plan (the second section) that details how much revenue you expect to generate, how much capital you need to reach those goals, and what sort of ROI on investment you’ll get (ROI stands for return on investment)

- A market research report (third section) which includes data about what other businesses do in this area, how many competitors there are in general, and specifics about any competitors within your target market who might be

An Investor Pitch Deck Structure You Can Steal And Not Say THANK YOU

Title Slide:

- Company Logo and Name

- Tagline or Slogan

- Presenter’s Name and Title

- Date

Slide 1: The Problem

- Clearly define the problem your product or service aims to solve

- Highlight the pain points experienced by your target market

- Use statistics or real-life examples to emphasize the magnitude of the issue

Slide 2: The Solution

- Introduce your product or service as the answer to the problem

- Describe its unique features and benefits

- Explain how it differentiates from existing solutions in the market

Slide 3: Market Opportunity

- Present the size of the target market

- Explain the growth potential and trends within the industry

- Identify your target customer segments

Slide 4: Business Model

- Describe how your company generates revenue

- Outline your pricing strategy and sales channels

- Provide an overview of any partnerships or strategic alliances

Slide 5: Traction and Milestones

- Share key metrics that demonstrate market validation and traction

- Highlight notable customer successes or testimonials

- Outline significant milestones achieved and future milestones planned

Slide 6: Marketing and Sales Strategy

- Detail your customer acquisition strategy, including marketing channels and tactics

- Describe your sales process and customer retention initiatives

- Provide an overview of your marketing budget and expected return on investment

Slide 7: Competitive Landscape

- Identify your main competitors

- Analyze their strengths and weaknesses

- Explain how your product or service differentiates from the competition

Slide 8: Management Team

- Introduce key team members, their roles, and their relevant experience

- Highlight any industry experts or advisors involved

- Describe how the team is positioned to lead the company to success

Slide 9: Financial Projections

- Provide a summary of key financial metrics (revenue, profit, expenses, etc.)

- Present a 3-5 year financial forecast

- Explain any assumptions or risks associated with your projections

Slide 10: Funding Request and Use of Funds

- State the amount of investment you are seeking

- Detail how the funds will be allocated (e.g., product development, marketing, hiring, etc.)

- Explain how the investment will help your company achieve its goals

Slide 11: Exit Strategy

- Outline potential exit scenarios for investors (e.g., acquisition, IPO, etc.)

- Provide examples of recent exits within the industry

- Estimate a timeline for a potential exit

Slide 12: Thank You and Contact Information

- Express gratitude for the audience’s time and consideration

- Provide contact details for further discussion or follow-up

- Include any relevant social media handles or website URLs

Important Do’s and Don’ts

When creating a pitch deck that you want to present to potential investors, there are some critical do’s and don’ts to remember.

Firstly, it’s important to tell a story with your deck – investors want to understand your business idea and how it will make money from just looking at your slides. This means creating a cohesive narrative that flows from one slide to the next. To help you improve your narrative, check this selection on the best books for pitching. The authors have won billions in $ thanks to their ability to create stories when pitching and are sharing their methods with you.

Secondly, while it’s important to be original, don’t try to reinvent the wheel – there are certain elements (mentioned above) that every successful pitch deck contains, so make sure yours has them too.

Finally, it is also essential to practice delivering the pitch before actually meeting with investors. This will help ensure that the presentation is polished and professional.

Also If you want to make sure that you have a great deck that is well-organized and easy for investors to digest, use bullet points instead of paragraphs; this will give them more time to read through the information without having to spend too much time on each section.

Don’t forget that the purpose of a pitch deck is to get investors interested in your business – so make sure you have an original deck that is well-designed, visually appealing and catches the eye. This means using original graphics and avoiding busy slides. You want to show that your deck can stand alone and be able too tell the story of your business.

Hold on. You might want to check my list on the best presentation books. Why?

It’s 1O crucial books that will help you improve the design and structure of your presentations, besides improving its delivery. Check it out below.

In the end, you should be able to answer any questions they have quickly, so prepare yourself accordingly. It’s probably not the best idea to go into too much detail or talk about things that aren’t relevant or important to them – just stick to the main points.

If you want to really get into some of the mistakes that are common and I have personally made while making a pitch deck for fundraising, check out my pitch deck mistakes article.

What nobody will tell you: Crucial considerations to keep in mind when developing your investor pitch deck and business

10 insights. These are things no advisor, startup event organizer or coach will tell you for free. We’ve done the research and combined it with our experience to give you these insights with no strings attached.

Understanding Investor Mindset in Pitch Deck Creation

Insight: Grasping the investor mindset is crucial in crafting a pitch deck that not only informs but also persuades and inspires confidence. Investors are typically looking for more than just a great business idea; they seek assurance that the team behind the idea is capable, the market opportunity is significant, and the potential for return on investment is high.

Research-Based Understanding:

- Risk vs. Reward Analysis: A study by Harvard Business Review highlighted that investors often weigh the potential reward against the risk involved. They prefer ventures that present a balanced risk-reward ratio.

- Team Competence: According to Forbes, investors often invest in the team as much as the idea. Their confidence in the team’s ability to execute the plan is pivotal.

- Market Viability: Research in the Journal of Business Venturing indicates that investors look for a clear understanding of the market size, growth potential, and competitive landscape.

Actionable Steps:

- Showcase Team Strength: Highlight the expertise and track record of your team. Emphasize relevant experiences, past successes, and unique skills that contribute to the potential success of the venture.

- Articulate Risk Management: Clearly outline the potential risks and your strategies for mitigating them. This could include market risks, competitive risks, or operational risks.

- Demonstrate Market Understanding: Present well-researched data on market size, growth projections, and target audience. Show that you understand not just the current market, but also future trends and dynamics.

- Financial Acumen: Exhibit a clear plan for revenue generation and profitability. Investors want to see a well-thought-out financial model with realistic, yet ambitious projections.

- Scalability Potential: Highlight how your business can scale. Investors are interested in ideas that can grow rapidly and capture significant market share.

- Clear Value Proposition: Be explicit about what sets your offering apart. A unique value proposition that is easily understandable and compelling is key.

- Exit Strategy: Present a clear exit strategy, as it directly relates to their return on investment. Whether it’s an IPO, acquisition, or other routes, showing that you’ve thought about the endgame is important.

By aligning your pitch deck with these insights into the investor mindset, you increase the chances of resonating with potential investors, making your presentation not just informative but compelling and investment-worthy. Up next, we’ll explore how effective storytelling techniques can enhance your pitch deck, creating an emotional connection with investors while conveying your business’s potential.

Effective Storytelling Techniques in Pitch Deck Creation

Insight: The power of storytelling in pitch decks is not just about captivating your audience; it’s about making your business idea memorable and relatable. Effective storytelling can transform a pitch from a mere presentation of facts into a compelling narrative that highlights the journey, vision, and potential impact of your business.

Research-Based Understanding:

- Emotional Connection: A study published in the Journal of Brand Management found that narratives in business contexts that create an emotional connection can significantly influence investment decisions.

- Memorability: Research in Psychological Science suggests that information presented in a story format is more likely to be remembered than facts listed in bullet points.

- Clarity and Persuasion: According to Harvard Business Review, a well-structured story can clarify complex ideas and increase persuasiveness.

Actionable Steps:

- Start with a Hook: Begin your pitch with an engaging story or a compelling problem that your business is solving. This sets the tone and grabs attention from the start.

- Personalize the Narrative: Share a personal story or the founding story of your business. This humanizes your pitch and makes it more relatable.

- Show the Journey: Illustrate the journey of your business – from the initial idea, the challenges faced, to the current success and future vision. This showcases resilience and ambition.

- Use Visual Storytelling: Incorporate visuals to aid your storytelling. Use images, graphs, and diagrams to illustrate points, making complex information more digestible.

- Highlight Customer Stories: Include testimonials or case studies from your customers. This not only validates your business but also demonstrates real-world impact.

- Emphasize the ‘Why’: Clearly articulate why your business exists and why it matters. This goes beyond the ‘what’ and ‘how’, touching on the purpose and impact of your venture.

- Build a Narrative Arc: Structure your pitch like a story, with a clear beginning (problem), middle (solution), and end (vision for the future). Ensure a logical flow that builds interest throughout.

- Conclude with a Strong Call to Action: End your story by clearly stating what you want from the investors and what they stand to gain, aligning it with the narrative you’ve built.

By integrating these storytelling techniques into your pitch deck, you create a more engaging, memorable, and persuasive presentation. This approach not only conveys the facts but also connects emotionally with investors, enhancing the overall impact of your pitch. Next, we’ll delve into the importance of data visualization and design principles in your pitch deck, ensuring that your story is not only told but also seen in the best light.

Data Visualization and Design Principles in Pitch Deck Creation

Insight: Effective data visualization and thoughtful design in pitch decks are not just aesthetic choices; they are communication tools that can significantly enhance the clarity and impact of your presentation. Good design and clear data representation can make complex information more accessible, helping investors quickly understand and remember key points.

Research-Based Understanding:

- Cognitive Load Management: Research from the field of cognitive psychology suggests that well-designed visuals can reduce cognitive load, making it easier for investors to process and retain information.

- Impact of Visuals on Persuasion: A study in the Journal of Business Communication found that presentations using visual aids were found to be 43% more persuasive than unaided presentations.

- Information Recall: According to research published in the Journal of Education and Business, information presented visually is more likely to be remembered than the same information given verbally.

Actionable Steps:

- Simplify Complex Data: Use charts, graphs, and infographics to present complex data like market analysis, financial projections, and business metrics. Simplified visuals help in quick understanding.

- Consistent Design Theme: Adopt a consistent color scheme, typography, and layout throughout the pitch deck. This consistency gives your presentation a professional look and feel.

- Use of Colors and Fonts: Choose colors and fonts that are easy to read and align with your brand identity. Avoid overly decorative fonts and extremely bright or clashing colors.

- Visual Hierarchy: Arrange elements in a way that naturally guides the viewer’s eye across the slide. Important information should stand out and be easily identifiable.

- Avoid Clutter: Keep slides uncluttered. Too much information or too many visuals on one slide can be overwhelming. Use white space effectively to make the content more digestible.

- Relevant Imagery: Use images that reinforce your message. Avoid generic stock photos; opt for images that are directly relevant to your content and add value to your story.

- Data Storytelling: Integrate data visualization with storytelling. Let your charts and graphs narrate the progress, challenges, and successes of your business journey.

- Interactive Elements: If possible, incorporate interactive elements like clickable data points for a more engaging experience, especially in digital pitch decks.

By prioritizing these data visualization and design principles, your pitch deck will not only convey your message more effectively but also leave a lasting impression on investors. These enhancements ensure that your pitch is both visually appealing and substantively rich, facilitating better understanding and retention of your business proposition. Next, we’ll explore market analysis and validation techniques, critical for demonstrating the viability and potential of your business idea to investors.

Market Analysis and Validation in Pitch Deck Creation

Insight: Conducting a thorough market analysis and validation is a cornerstone of an effective investor pitch deck. It demonstrates to investors that you have a deep understanding of your market and provides evidence that your business idea has a viable place in it. This section of your pitch deck should convincingly illustrate market demand, size, growth potential, and your business’s unique fit.

Research-Based Understanding:

- Market Size and Growth Potential: According to a Harvard Business School report, investors prioritize understanding the market size and growth potential to gauge the scalability and long-term viability of a business.

- Customer Validation: Research in the Journal of Business Venturing Insights shows that demonstrating customer validation, such as through pilot studies or early sales, significantly increases investor confidence.

- Competitive Landscape Analysis: A study in the Strategic Management Journal emphasizes the importance of a comprehensive competitive analysis, showing awareness of market dynamics and potential threats.

Actionable Steps:

- Quantify the Market Size: Use reliable data sources to define the total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM). This shows investors the potential market reach.

- Highlight Market Growth: Present trends and forecasts that demonstrate the market’s growth trajectory. Use graphs and charts to make this data easily digestible and visually impactful.

- Customer Insights and Validation: Share results from customer surveys, testimonials, or case studies. Real-world evidence of your product or service’s appeal and usefulness can be very persuasive.

- In-Depth Competitive Analysis: Go beyond listing competitors. Analyze their strengths, weaknesses, and how your business differentiates itself. This could include a unique value proposition, better technology, or innovative business models.

- Address Market Needs and Gaps: Clearly articulate how your product or service meets an existing market need or addresses a gap in the market. This could be through innovation, better efficiency, or improved customer experience.

- Regulatory Environment Overview: If relevant, include information on the regulatory landscape of your industry. This shows that you’re aware of potential challenges and are prepared to navigate them.

- Leverage Data Visualizations: Use charts and infographics to make your market analysis more engaging and understandable. Visual representations of market data can have a stronger impact than text alone.

- Scenario Analysis: Present best-case and worst-case scenarios based on market conditions. This demonstrates to investors that you have considered different market situations and are prepared for them.

By effectively presenting your market analysis and validation in your pitch deck, you’ll not only establish credibility but also help investors see the true potential of your business in a tangible, data-driven way. This approach reassures them of your business acumen and the thoroughness of your market understanding. Next, we’ll delve into financial

modeling and projections, an essential component that investors scrutinize closely, to ensure your pitch deck aligns with financial expectations and demonstrates economic viability.

Financial Modeling and Projections in Pitch Deck Creation

Insight: Financial modeling and projections are critical elements of a pitch deck, providing investors with a clear picture of your business’s financial health and potential. Accurate and realistic financial projections demonstrate to investors that you have a solid grasp of your business’s economic aspects and a clear plan for future growth and profitability.

Research-Based Understanding:

- Investor Decision Making: Research in the field of entrepreneurial finance indicates that accurate financial projections are key factors in investment decision-making. Investors look for realistic, data-driven projections to assess the potential return on investment.

- Market Realism: A study in the Journal of Business Venturing suggests that financial models grounded in market realism are more likely to gain investor confidence. Unrealistic optimism in financial projections can be a red flag for investors.

- Growth Potential Assessment: According to Harvard Business Review, investors use financial models to evaluate the scalability and long-term growth potential of a business.

Actionable Steps:

- Develop a Robust Financial Model: Create a comprehensive financial model that includes income statements, cash flow projections, and balance sheets. Ensure that these models are detailed and accurately reflect your business operations.

- Realistic Revenue Projections: Base your revenue projections on market research and realistic assumptions. Clearly outline the assumptions behind your projections to provide context to investors.

- Break-Even Analysis: Include a break-even analysis to show when your business will become profitable. This helps investors understand the timeline for expected returns.

- Cost Structure Explanation: Detail your cost structure, including fixed and variable costs. Understanding the cost dynamics is essential for investors to assess financial sustainability.

- Scenario Analysis: Provide best-case and worst-case financial scenarios. This not only demonstrates thorough planning but also prepares potential investors for various market conditions.

- Funding Use Breakdown: Clearly articulate how you plan to use the funding. Investors want to know how their money will drive growth and profitability.

- Historical Financials: If applicable, include historical financial data. This adds credibility and allows investors to assess your financial management skills.

- Key Metrics and KPIs: Highlight key financial metrics and performance indicators relevant to your business. These could include customer acquisition cost, lifetime value, gross margin, etc.

By presenting well-thought-out financial modeling and projections in your pitch deck, you convey to investors that you understand the financial implications of your business strategy and are prepared for sustainable growth. This level of detail and realism in financial planning is crucial for gaining investor trust and support. Next, we’ll move on to the importance of structuring your pitch deck effectively, ensuring that each element flows logically and contributes to a compelling overall narrative.

Pitch Deck Structure and Flow

Insight: The structure and flow of your pitch deck are fundamental in guiding investors through your business narrative in a coherent and impactful way. A well-organized pitch deck not only helps maintain investor attention but also ensures that key points are communicated effectively and memorably.

Research-Based Understanding:

- Cognitive Flow: According to cognitive science research, a logical flow of information helps in better understanding and retention. A structured presentation aligns with how the human brain processes information.

- Narrative Persuasion: Research in the field of marketing and communication suggests that a narrative with a clear beginning, middle, and end is more persuasive and engaging than a disjointed presentation.

- Investor Focus: A study in Entrepreneurship Theory and Practice journal indicates that investors prefer pitch decks that logically progress from problem identification to solution, market validation, and financials.

Actionable Steps:

- Start with a Strong Opening: Begin with a compelling introduction that outlines the problem you’re solving or the opportunity you’re seizing. This sets the stage for your narrative.

- Present the Solution Clearly: After introducing the problem, transition smoothly into your solution. Explain how your product or service addresses the problem effectively.

- Market Validation and Size: Follow up with market analysis, showing the size and growth potential of your market, and how your solution fits in.

- Business Model Explanation: Clearly articulate your business model. How do you plan to make money? What are your revenue streams?

- Competitive Analysis: Include a section on your competition and your unique value proposition. Show how you differentiate from others in the market.

- Financials and Projections: Present your financial modeling, including revenue projections and key financial metrics. Ensure this section flows logically from your business model.

- The Team Behind the Venture: Introduce your team, highlighting their expertise and roles. Investors invest in people, not just ideas.

- Funding Needs and Use: Clearly state how much funding you need and how it will be used. Link this to your growth plans and financial projections.

- Closing with a Call to Action: End with a strong closing that reiterates the opportunity and invites investors to be a part of your journey.

- Consistency in Design: Ensure that your design is consistent throughout the deck, with each slide complementing the overall narrative.

By carefully structuring your pitch deck, you create a narrative that is not only easy to follow but also compelling and persuasive. This structure helps investors understand your business holistically, increasing the chances of investment. Next, we will explore how to incorporate technology and innovation into your pitch deck, ensuring that your presentation is not only informative but also cutting-edge and engaging.

Incorporating Technology and Innovation in Your Pitch Deck

Insight: In today’s rapidly evolving business landscape, showcasing how technology and innovation are integral to your business can significantly enhance your pitch deck’s appeal. It demonstrates forward-thinking and positions your venture as a potential leader in leveraging emerging trends for competitive advantage.

Research-Based Understanding:

- Investor Attraction to Innovation: A study in the Academy of Management Journal reveals that investors are often attracted to businesses that incorporate innovative technologies, as they are perceived to have higher growth potential.

- Technology as a Differentiator: Research from Harvard Business Review indicates that businesses that effectively use technology as a differentiator are more likely to secure investment, as they are seen as better equipped to disrupt the market.

- Adaptability and Future-Proofing: According to a report in the Journal of Business Venturing, companies that demonstrate adaptability and future-proofing through technology integration are considered more resilient and sustainable, which is a key factor for investors.

Actionable Steps:

- Highlight Technological Integration: Clearly articulate how technology is integrated into your product or service. Explain how it enhances your offering, improves efficiency, or creates a unique user experience.

- Showcase Innovations: If

your business has developed innovative solutions or proprietary technology, highlight these aspects. Describe how your innovation sets you apart from competitors and adds value to your customers.

- Demonstrate Market Relevance: Link your technological capabilities to market trends and customer needs. Show how your technology addresses current market demands and can adapt to future changes.

- Provide Evidence of Impact: Use case studies, testimonials, or pilot study results to demonstrate the effectiveness of your technology. Real-world examples of how your technology has made a difference can be very persuasive.

- Discuss R&D Efforts: If you have ongoing research and development, discuss these initiatives. This shows commitment to continuous innovation and improvement.

- Future Technological Roadmap: Share your vision for future technological advancements. This could include upcoming features, planned improvements, or new products in the pipeline.

- Tech-Savvy Presentation: Use the pitch deck itself to showcase your technological proficiency. Consider including interactive elements, digital demos, or augmented reality experiences if applicable.

- Address Scalability: Discuss how your technology can scale. Investors will be interested in understanding how your technological solution can grow and handle increased demand or expansion into new markets.

- Intellectual Property: If applicable, mention any patents or intellectual property rights you hold. This adds credibility and can be a significant asset in the eyes of investors.

- Cybersecurity and Data Privacy: Briefly address how you handle data security and privacy, especially if your technology deals with sensitive user data. This reassures investors of your responsibility and foresight.

By effectively incorporating technology and innovation into your pitch deck, you not only showcase your business as a cutting-edge player in your field but also align with the interests of modern investors who are keen on funding technologically advanced and innovative ventures. This approach can significantly elevate the appeal of your pitch deck in the eyes of potential investors. Next, we will delve into the nuances of addressing competition and articulating your unique selling proposition (USP), ensuring your business stands out in a crowded marketplace.

Addressing Competition and USP (Unique Selling Proposition) in Your Pitch Deck

Insight: Effectively addressing competition and articulating your Unique Selling Proposition (USP) in your pitch deck is crucial. It demonstrates to investors that you have a clear understanding of your market position and how your business differentiates itself. This section of the pitch reassures investors that you are prepared to navigate and succeed in a competitive landscape.

Research-Based Understanding:

- Investor Concern for Market Position: A study in the Journal of Marketing found that investors give significant importance to a business’s market position and its strategy to outperform competitors.

- Importance of a Clear USP: Research in Strategic Management Journal emphasizes that businesses with a clear USP are more likely to attract investment, as they are perceived to have a competitive edge.

- Competitive Analysis and Business Performance: According to Harvard Business Review, there’s a strong correlation between thorough competitive analysis and business performance, which is a critical factor for investors.

Actionable Steps:

- Conduct a Detailed Competitive Analysis: Present a well-researched competitive landscape, including direct and indirect competitors. Use frameworks like SWOT (Strengths, Weaknesses, Opportunities, Threats) to structure your analysis.

- Clearly Define Your USP: Articulate what sets your product or service apart. Is it your technology, business model, cost efficiency, customer service, or something else? Be specific and convincing.

- Market Positioning Map: Include a positioning map to visually represent where your business stands relative to competitors on key attributes like price, quality, or innovation.

- Evidence to Support Your USP: Back up your USP with data, customer testimonials, or case studies. Showing real-world evidence of your competitive advantage is persuasive.

- Discuss Your Response to Competition: Explain how you plan to respond to competitive pressures and market changes. This demonstrates strategic thinking and adaptability.

- Highlight Barriers to Entry: If applicable, mention any barriers to entry that protect your market position, such as patents, exclusive partnerships, or high capital requirements.

- Future Competitive Strategy: Outline your strategies for maintaining or enhancing your competitive edge in the future, considering potential market shifts and emerging competitors.

- Customer Focus: Emphasize how your understanding of customer needs and preferences contributes to your competitive advantage.

- Innovative Approaches to Market Challenges: Show how your business is uniquely equipped to solve market challenges in ways that competitors can’t or haven’t yet considered.

- Leverage Storytelling: Use a narrative to convey how your business came to its current position, the challenges you’ve overcome, and how you’re uniquely equipped to succeed in the market.

Addressing competition and highlighting your USP effectively in your pitch deck is crucial for establishing credibility and attracting investors. It illustrates not only your market savvy but also your business’s potential for long-term success. Up next, we will explore the importance of understanding and conveying your business’s risk management strategies to investors.

Legal and Ethical Considerations in Your Pitch Deck

Insight: Addressing legal and ethical considerations in your pitch deck is essential to establish trust and credibility with investors. Demonstrating a clear understanding and adherence to legal norms and ethical standards not only mitigates potential risks but also positions your company as a responsible and sustainable investment.

Research-Based Understanding:

- Investor Concern for Compliance: According to a survey by the Association of Certified Fraud Examiners, compliance with legal standards is a key factor investors consider to avoid future liabilities and reputation damage.

- Ethical Business Practices and Investment: Research in the Journal of Business Ethics found that ethical business practices positively influence investment decisions, as they are linked to long-term business sustainability and reputation.

- Legal Pitfalls Impacting Investments: A Harvard Law School study indicates that legal issues, especially in areas like intellectual property and regulatory compliance, can significantly impact investment decisions.

Actionable Steps:

- Outline Compliance with Industry Regulations: Detail how your business complies with relevant industry regulations and standards. This is particularly crucial for industries like healthcare, finance, or technology.

- Intellectual Property Rights: If applicable, discuss your intellectual property status, including patents, trademarks, or copyrights. Clarify any pending applications or potential infringements.

- Data Privacy and Protection: For businesses handling customer data, address how you comply with data protection laws like GDPR or CCPA. This reassures investors of your commitment to user privacy.

- Ethical Business Practices: Highlight any ethical business practices you adhere to, such as fair labor practices, sustainable sourcing, or corporate social responsibility initiatives.

- Legal Team or Advisory: Mention if you have legal advisors or a legal team. This shows you are well-prepared to handle legal matters and are taking proactive steps to stay compliant.

- Risk Mitigation Strategies: Discuss strategies you have in place to mitigate legal and ethical risks, such as regular compliance audits or ethical training for employees.

- Transparency in Operations: Emphasize your commitment to transparency in your business operations, which is a key factor in building trust with investors.

- Address Past Legal Challenges: If your company has faced legal challenges in the past, briefly address these and explain how they were resolved and what measures have been implemented to prevent future issues.

- Investor Due Diligence: Acknowledge the importance of due diligence and express your willingness to provide any necessary information for investor verification processes.

- Future Legal Plans: If there are future legal milestones or anticipated changes in regulation that could affect your business, mention these and your preparedness plans.

By comprehensively addressing legal and ethical considerations in your pitch deck, you reassure investors of your business’s integrity and preparedness for potential challenges. This approach not only builds confidence in your venture but also highlights your commitment to operating a responsible and sustainable business. Next, we will delve into the importance of including success stories and case studies in your pitch deck, to provide concrete evidence of your business’s impact and potential.

Success Stories and Case Studies in Your Pitch Deck

Insight: Incorporating success stories and case studies in your pitch deck serves as powerful evidence of your business’s impact and potential. These real-world examples provide tangible proof of your product or service’s effectiveness and resonate emotionally with investors, augmenting the factual data with relatable narratives.

Research-Based Understanding:

- Narrative Persuasion: Research in the field of psychology suggests that stories are more persuasive than statistics alone. A study in the Journal of Consumer Research found that narrative storytelling increases empathy and emotional engagement, influencing decision-making.

- Evidence of Market Fit: According to a Harvard Business School publication, case studies demonstrating market fit and customer satisfaction are crucial for investor confidence. They serve as proof that your business model works in a real-world setting.

- Building Credibility: A report in the Journal of Business Venturing indicates that startups with demonstrable customer success stories are perceived as more credible and are more likely to receive funding.

Actionable Steps:

- Select Relevant Success Stories: Choose success stories or case studies that are most relevant to your target investors. Focus on those that demonstrate clear problem-solving and value addition.

- **Quantify Results

**: Wherever possible, use quantifiable results to illustrate the impact of your product or service. This could include metrics like customer growth, revenue increase, cost savings, or improved efficiency.

- Customer Testimonials: Include testimonials from satisfied customers, especially if they are well-known or respected in your industry. This adds authenticity and relatability to your claims.

- Before and After Scenarios: Present a clear picture of the situation before and after the adoption of your product or service. This highlights the tangible difference your business makes.

- Visual Elements: Use photographs, charts, or other visual elements to make the case studies more engaging and easier to understand at a glance.

- Narrative Format: Frame these case studies as stories with a clear beginning (customer challenge), middle (implementation of your solution), and end (results and benefits).

- Diverse Range of Examples: Include a variety of case studies that showcase the breadth of your product’s or service’s applications. This demonstrates versatility and a broader market appeal.

- Link to Business Goals: Ensure that each success story aligns with and reinforces your overall business goals and the key messages of your pitch.

- Addressing Challenges: If there were challenges or obstacles in these success stories, discuss how they were overcome. This shows your problem-solving ability and resilience.

- Future Potential: Use these success stories to extrapolate the future potential of your business. How can these successes be scaled or replicated to indicate future growth?

Incorporating well-crafted success stories and case studies in your pitch deck provides compelling, real-world evidence of your business’s value and potential. This approach not only enhances the credibility of your pitch but also helps in creating an emotional connection with your audience, making your business proposition more memorable and impactful. Next, we’ll explore how to effectively communicate your post-pitch strategy, ensuring investors understand your plans for maintaining momentum and building relationships after the initial pitch.

Post-Pitch Strategy in Your Pitch Deck

Insight: Articulating a clear post-pitch strategy in your pitch deck is essential for establishing a roadmap for what comes after the investor presentation. It shows potential investors that you are not only prepared for the pitch itself but also for the critical steps that follow, demonstrating foresight and strategic planning.

Research-Based Understanding:

- Importance of Follow-Up: A study in the Harvard Business Review highlights the significance of follow-up in the investment process. Effective follow-up strategies can significantly increase the likelihood of securing investment.

- Building Investor Relationships: Research in the Journal of Business Venturing shows that ongoing engagement and relationship building post-pitch are crucial for successful funding outcomes.

- Managing Expectations: According to a report in Entrepreneurship Theory and Practice, clear communication post-pitch helps manage investors’ expectations and can lead to more productive negotiations.

Actionable Steps:

- Immediate Follow-Up Plan: Outline a plan for how you will follow up after the pitch. This could include a thank-you email, sending additional information, or setting up further meetings.

- Timeline for Key Milestones: Provide a timeline for expected key milestones post-investment. This shows investors how their funds will be used and what results they can expect, and when.

- Communication Strategy: Develop a strategy for regular updates and communications with potential investors. Specify the frequency and channels of these updates.

- Feedback and Adaptation: Express openness to feedback and show how you plan to adapt your business strategy based on investor input.

- Investor Engagement: Discuss how you plan to keep investors engaged and informed about your business progress. This can include investor newsletters, reports, or regular meetings.

- Dealing with Rejections: Have a plan for how to handle potential rejections or requests for more information. This could involve refining your pitch or exploring different funding avenues.

- Long-term Relationship Building: Highlight how you envision building long-term relationships with your investors. Investors are not just a source of funds; they can also be advisors and advocates for your business.

- Contingency Plans: If immediate investment is not secured, explain your contingency plans. This could include bootstrapping, seeking alternative funding sources, or pivoting your business model.

- Metrics for Success Measurement: Define clear metrics for measuring the success of your post-pitch strategy. This could include investor interest levels, the number of follow-up meetings, or the amount of feedback received.

- Legal and Financial Preparations: Be prepared for due diligence. Ensure all your legal and financial documents are in order, and you are ready to share them with potential investors.

Incorporating a well-thought-out post-pitch strategy in your pitch deck shows potential investors that you are prepared for the entire investment journey, not just the initial presentation. This level of preparedness can significantly increase your credibility and attractiveness as an investment opportunity. Next, we will discuss the critical elements of a pitch deck’s design and aesthetics, ensuring that your presentation is not only informative but also visually compelling and professional.

Use these insights and make a winning pitch. If you want to talk about them, reach out to me and book a call.

How to creatively pitch your investor startup pitch deck?

Pitching your startup to investors requires a blend of creativity, boldness, and strategic thinking. Here are some novel and attention-grabbing ideas you can implement when presenting your investor pitch deck on stage:

- Interactive Product Demo: If your product is tangible or tech-based, start with a live, interactive demo. For instance, use augmented reality or virtual reality to give investors a futuristic experience of your product.

- Narrative Through Theatre: Turn your pitch into a short theatrical performance, where team members act out a problem your startup solves, making the issue and your solution vividly clear and memorable.

- Pitch in Reverse: Start your presentation with where you see your company in the future, then work backwards to the present, outlining the steps you’ll take to get there. This ‘reverse storytelling’ can be a compelling way to illustrate your vision.

- Surprise Guest Testimonials: Bring in a surprise guest, like a satisfied customer or a small celebrity/known figure in your industry, to provide a live testimonial about your product or service.

- Flash Mob Style Presentation: Coordinate a flash mob to creatively demonstrate a problem or the need for your solution. This could involve audience participation or a surprise element that unfolds during your pitch.

- Interactive Polls or Q&A Sessions: Use technology to create real-time polls or Q&A sessions during your presentation. This not only engages your audience but also demonstrates your commitment to feedback and adaptability.

- Incorporate an Artistic Performance: Fuse your pitch with an artistic element like a musical performance or live painting that metaphorically represents your business journey or solution.

- Use of Illusions or Magic Tricks: Employ a magician to illustrate your points through illusions, symbolizing how your product or service can ‘magically’ solve problems.

- Custom Animation or Short Film: Create a custom animation or short film that tells the story of your business, showcasing your creativity and making your pitch unforgettable.

- Personal Storytelling: Share a powerful and personal story that led to the inception of your business. Connect this story emotionally with your audience to make your pitch more relatable.

- Tech-Driven Presentation: Utilize cutting-edge technology like holograms or 3D projections to present your ideas in a visually stunning way.

- Gamify Your Pitch: Turn your presentation into a short, interactive game where investors participate, directly engaging them in your business model or value proposition.

Remember, the key to a successful creative pitch is not just the novelty but also its relevance to your business and its ability to clearly communicate your value proposition. While creativity can capture attention, ensure that the core message of your business is not lost in the spectacle.

Best Investor Pitch Deck Examples

Let’s take a look at some of the best pitch deck examples when it comes to the ones made particularly for investors and how they have told the story of their business:

Fyre Festival Pitch Deck

The notorious Fyre Festival pitch deck through which McFarland secured over $27 million in funding from over 100 investors.

Coinbase Pitch Deck

Coinbase is a trading and exchange platform for digital currencies of American origin.

When bitcoin was still relatively unknown in 2012, Coinbase was able to raise $600K in funding successfully.

Coinbase has raised nearly $550 million in investment after nine rounds. The corporation is now valued between $1 billion and $10 billion.

Contently Pitch Deck

With the help of this pitch deck, Contently raised $9M in fundraising in 2014. Jackson Square Ventures was one of the round’s leading investors.

Up to this point, Contently has raised $19.3M in investment across seven rounds.

Shift Pitch Deck

This Shift pitch deck was utilized to secure a $24 million series A funding. They have received $112 million in total, with the most recent round being a $38.4 million seed to series C led by BMW I Ventures.

Christian Ohler, George Arison, Minnie Ingersoll, and Morgan Knutson developed this online marketplace for cars in 2013.

Facebook Pitch Deck

Back in 2004, Facebook was created by Mark Zuckerberg and a small group of his fellow Harvard students as a way for college and university students to connect with one another.

Without receiving their first angel investment from PayPal co-founder and billionaire entrepreneur and investor Peter Thiel in the summer of 2004, Facebook’s founders would not have been able to lead the platform to such success.

By 2022, Facebook will have more than 2.9 billion users worldwide and will be the most popular social network in the vast majority of nations. This makes Facebook the biggest and most effective social media site in use, with a net worth of almost $545 billion.

Best Templates

There are a number of free templates available online when it comes to making a pitch deck for investors. These can be a great starting point for companies looking to raise capital and can help ensure that your presentation is professional and on-brand. All of these are revered amongst the Silicon Valley startups so check them out:

Sequoia Capital Pitch Deck

Y Combinator pitch deck

Your Copy Of My Personal Pitch Deck Template

So, you’ll need to warm up that chair, fire up Keynote and spend hours creating an investor pitch deck.

The good news is you don’t have to make decks from scratch. Creating an effective investor pitch deck is all about knowing what slides to include and how to structure them. You can find thousands of templates on sites like Canva, Slidesgo, and Google Slides, but none will align with your brand.

What will happen is you’ll need to spend hours adjusting these templates to fit your brand.

There’s a better way.

My clients have used my written template to craft stellar investor pitch decks in half the time and designed a deck that secured their new investment.

Owners Also Ask:

What’s the difference between a startup pitch deck and an investor pitch deck?

The key difference between the startup pitch deck and the investor pitch deck is the target audience. Startup pitch decks are used to present in front of various crowds not just investors, whereas investor pitch decks are used to present in front of investors.

What’s a series a pitch deck?

A series a pitch deck is a type of presentation that entrepreneurs use to raise series A funding from investors. The deck is typically around 20 slides and covers topics like the problem the startup is solving, the market opportunity, the team, the business model, and the financials.

What’s a series b pitch deck?

A series B pitch deck is a presentation that entrepreneurs give to potential investors when seeking series B financing. Series B financing is the second stage of venture capital funding. It usually comes after a company has achieved some initial traction and is looking to scale up. In order to get a series B investment, a company needs to have a strong story to tell investors. The pitch deck is one of the main ways in which entrepreneurs communicate this story.

Why is the airbnb pitch deck so popular?

The airbnb pitch deck is so popular because it is an efficient and effective way to raise money for a startup (not to mention the fact that the company is now worth billions). The pitch deck is a short presentation that outlines the key points of a business, and airbnb has perfected this format. Their pitch deck is simple, yet thorough, and investors can quickly understand the potential of the business. In addition, the airbnb team is very experienced in pitching their business, and they have a track record of success. This makes investors feel confident in their decision to invest, and it also helps airbnb raise money more quickly than other startups.

How does the uber pitch deck look like?

The Uber pitch deck is a document that contains information about the company and its business model. It is used to convince potential investors to invest in the company. The deck typically includes slides with information about the company’s history, its business model, its financials, and its plans for the future.

Final Words

Although there are no strict guidelines for producing a successful pitch deck, following the guidelines in this guide will give you a good foundation and flow for making your own investor’s pitch deck.

Remember to focus on what makes your company unique and how you plan to generate returns for investors (venture capital).

You want to make sure your deck (or powerpoint) was used to tell a convincing story, backed up with solid data, and has been utilized for communicating your business’s goals effectively. If you do this, you can secure the funding you need to grow your business.

If you need more information regarding this topic or anything on pitch decks in general, feel welcome to check out my site https://viktori.co/ which specializes in this particular topic.

You got this!

But if you don’t got it:

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

More Resources For You

If you’re specifically looking to create a startup pitch deck, check my cornerstone guide on pitch decks that helped my clients win more than 4,000,000$ in funding:

You’ll learn how to create an investor pitch deck by following my bulletproof, step-by-step guide that helped my clients get $4+mill in funding. It includes information on the following:

- Building each slide (including elevator pitch slide, financials slide, and more)

- Best startup pitch deck examples

- What investors want to hear

- What a pitch deck is

- What a pitch deck isn’t

- Top slide decks to use and abuse

- Best practices when creating a pitch presentation

Also, these resources on pitch decks:

- 10 best books for pitching

- Pitch Deck Mistakes

- Agency Pitch Deck Guide

- Game Pitch Deck: A Guide

- Nonprofit Pitch Deck Guide

- What Is A TV Show Pitch Deck?

- What Is A Marketing Deck?

- Pitch deck for film: What is it?

- Podcast Pitch Deck

- Cannabis Pitch Deck

- Crypto Pitch Deck

- Social Media Pitch Deck Guide

- Documentary Pitch Deck

- SaaS Pitch Deck

- Biotech Pitch Deck Guide

- Medical Pitch Deck Guide

- Ecommerce Pitch Deck Guide

- https://viktori.co/edtech-pitch-deck-guide-template-examples/

- https://viktori.co/telecom-pitch-deck-guide-template-included/

If you want to learn how to create just a pitch, check out some of these resources: