Ever had a friend casually say, “I’m investing in apartments now,” and thought, “Wait, people do that?” Maybe you assumed this kind of investment was reserved for trust fund types or those fluent in financial jargon. But here’s the truth: apartment investing isn’t a VIP-only club—it’s for anyone with a strategy, a bit of know-how, and the right pitch.

I’m Viktor, a pitch deck expert and creative business strategist. Over the past 13 years, I’ve helped businesses secure millions of $ in funding thanks to my approach and I’m sharing it here in this pitch deck guide.

My goal? To help you craft a pitch so good that even the skeptics will wonder if they should cancel their gym membership to free up capital.

This deck is more than bullet points and glossy photos—it’s your playbook to convince investors that your apartment investment idea isn’t just solid; it’s irresistible. Whether you’re new to the game or need to level up your pitch, this guide will take you from “interesting idea” to “where do I sign?”

Fresh Case Study: Check out how we helped Cranwood Enterprises build a pitch deck for their senior living luxury real estate venture.

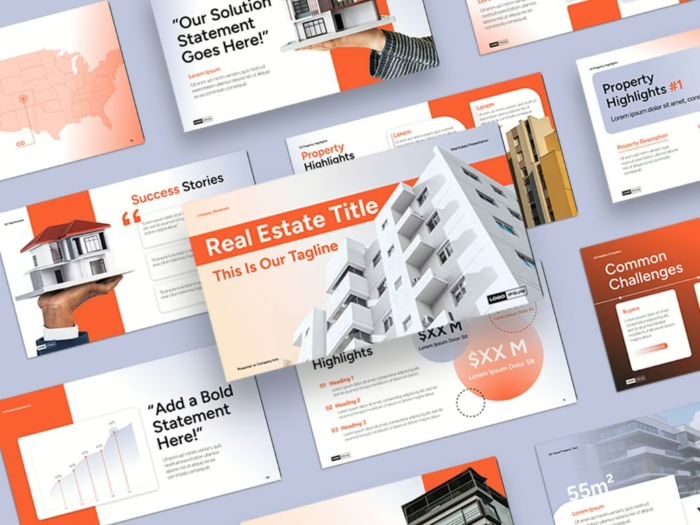

Here’s the 12-slide real estate template that’s helped raise $500M+:

- Built by a certified real estate pitch deck expert

- Investor-ready design, plug-and-play content.

Fully editable Powerpoint and Google Slides files. Get it while it’s available for a promo price of just $44.

Get an investor ready pitch deck that gets you funded and saves over 30 hours of your time.

Join 100s of successful entrepreneurs who’ve transformed their pitch decks by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

1 week turnaround time and less. Special pricing for early stage companies.

The least you will get on this call is 10 actionable tips & strategies to own that next pitch, worth $599, for free.

14 Slide Apartment Pitch Deck Template | Google Slides

1. Cover Slide

- Title: “Prime Investment Opportunity in [City/Region’s] Apartment Market”

- This title immediately conveys the essence of the pitch: a lucrative chance to invest in the apartment market of a specific area.

- Date: [Month, Year]

- Keeping the date current ensures that potential investors know the information is timely and relevant.

- Company/Entity Name: [Your Company’s Name]

- This establishes the entity that’s presenting the opportunity.

- Logo: (if applicable)

- A professional logo can add credibility and brand recognition.

2. Introduction

- Brief Overview of the Investment Opportunity:

- “We present a unique opportunity to invest in a growing and resilient apartment market in [City/Region], backed by a team with a proven track record.”

- Introduction to the Team:

- “Our team comprises real estate professionals with over [X years] of combined experience in property acquisition, management, and value optimization.”

3. Market Overview

- Current State of the Apartment Market:

- “The [City/Region] apartment market has seen a [X%] growth in the last year, with a [X%] increase in rental rates and a [X%] occupancy rate.”

- Growth Trends and Projections:

- “Forecasts indicate a steady [X%] annual growth over the next five years, driven by factors such as urbanization, job growth, and limited housing supply.”

- Key Market Drivers:

- “Several factors are propelling the apartment market in [City/Region]:”

- “Rising demand due to job opportunities in the area.”

- “Limited availability of single-family homes, making apartments a preferred choice for many.”

- “Increasing population density and urban migration.”

- “Favorable government policies promoting rental housing.”

- “Several factors are propelling the apartment market in [City/Region]:”

4. Opportunity

- Specific Details About the Apartments:

- “We’ve identified [X number of] properties, totaling [X number of] units, located in prime areas of [City/Region]. These properties offer a mix of studio, one-bedroom, and two-bedroom apartments, catering to a diverse tenant base.”

- Why Now is the Right Time to Invest:

- “With the current growth trajectory, property values are set to increase, offering a higher ROI. Additionally, the current interest rate environment and favorable lending conditions make it an opportune time for investment.”

- Potential for Returns:

- “Based on our projections and past performance, we anticipate an average annual ROI of [X%], with potential cash-on-cash returns of [X%] and a capital appreciation of [X%] over the investment period.”

5. Investment Strategy

- Property Sourcing and Acquisition:

- “Our team has established strong relationships with local brokers, property managers, and real estate professionals, ensuring we get first access to off-market deals and below-market value properties. Our rigorous due diligence process ensures we only select properties with the highest potential for growth and returns.”

- Value-Add Strategies:

- “Post-acquisition, our approach focuses on maximizing property value through:”

- “Targeted renovations to modernize units and common areas.”

- “Implementing efficient property management practices to reduce operational costs.”

- “Strategic marketing to attract and retain high-quality tenants, ensuring consistent rental income.”

- “Post-acquisition, our approach focuses on maximizing property value through:”

- Exit Strategy:

- “Our goal is to provide investors with both cash flow and capital appreciation. After a holding period of [X years], we aim to sell the properties, targeting a [X%] appreciation in value. Alternatively, we may consider refinancing to return capital to investors while retaining ownership.”

Just In: Luxury Senior Housing Pitch Deck Case Study. Find out how we helped Cranwood Enterprises build an investor ready deck.

6. Financial Projections

- Expected ROI:

- “Based on our analysis and market trends, we project an average annual ROI of [X%] over the investment period.”

- Cash Flow Projections:

- “Our properties are expected to generate a steady cash flow, with an estimated [X%] increase in rental income year-over-year, leading to a cash-on-cash return of [X%].”

- Break-Even Analysis:

- “Given our operational and financing costs, we anticipate reaching a break-even point by the end of year [X], post which all revenues will contribute directly to profit.”

- Sensitivity Analysis:

- “We’ve modeled various scenarios to account for market fluctuations:”

- “Best-case: [X%] ROI with optimal market conditions.”

- “Base-case: [X%] ROI, our most likely scenario.”

- “Worst-case: [X%] ROI in a downturned market.”

- “We’ve modeled various scenarios to account for market fluctuations:”

7. Deal Structure

- Capital Requirement:

- “We’re seeking to raise [$X million] to fund property acquisitions, initial renovations, and operational expenses.”

- Investment Terms:

- “Investors will receive an [X%] equity share in the properties, with a preferred return of [X%] annually.”

- Minimum Investment Amount:

- “To ensure a diversified group of investors and maintain operational efficiency, we’ve set a minimum investment threshold of [$X,000].”

8. Team

- Bios of Key Team Members:

- “[Name]: With over [X years] in real estate investment, [Name] has successfully managed [$X million] in assets, delivering consistent returns to investors.”

- “[Name]: An expert in property management, [Name] ensures our properties operate efficiently, maximizing rental income and tenant satisfaction.”

- “[Name]: With a background in finance, [Name] oversees our financial strategy, ensuring profitability and fiscal responsibility.”

- Roles and Responsibilities:

- “[Name]: Property Acquisition and Strategy”

- “[Name]: Operations and Property Management”

- “[Name]: Financial Planning and Investor Relations”

9. Case Studies (if applicable)

- Previous Project 1: [Property Name/Location]

- Acquisition Details: “Purchased in [Year] for [$X million], this [X-unit] apartment complex was located in [specific area].”

- Value-Add Initiatives: “We implemented a series of renovations, including [specific upgrades, e.g., “modernized kitchens, improved landscaping, and added amenities such as a gym and community lounge”].”

- Results: “Within [X years], we increased the occupancy rate from [X%] to [X%], leading to a [X%] increase in rental income. The property was sold in [Year] for [$X million], delivering a [X%] ROI to our investors.”

- Previous Project 2: [Property Name/Location]

- (Follow a similar format as above, detailing the acquisition, strategies employed, and the results achieved.)

10. Risks & Mitigation

- Market Fluctuations:

- Risk: “Real estate markets can be cyclical, with periods of downturn.”

- Mitigation: “Our focus on prime locations and value-add strategies ensures our properties remain attractive even in less favorable market conditions.”

- Operational Challenges:

- Risk: “Unexpected maintenance issues or vacancies can impact profitability.”

- Mitigation: “We maintain a reserve fund for unforeseen expenses and employ proactive marketing strategies to minimize vacancies.”

- Economic Factors:

- Risk: “Economic downturns can reduce rental demand or property values.”

- Mitigation: “Our properties cater to a diverse tenant base, reducing dependency on any single industry or economic sector.”

11. Timeline

- Year 1:

- “Q1-Q2: Finalize property acquisitions.”

- “Q3: Begin value-add renovations.”

- “Q4: Marketing initiatives to increase occupancy.”

- Year 2:

- “Q1: Completion of major renovations.”

- “Q2-Q4: Focus on property management and maximizing rental income.”

- Year 3-5:

- “Ongoing property management, periodic upgrades, and preparations for potential exit strategies.”

- Exit: “Targeting a property sale or refinancing by Year [X], depending on market conditions and investor preferences.”

12. Next Steps

- Due Diligence: “Interested investors can access a detailed due diligence package, including property appraisals, financial projections, and legal documentation.”

- Investment Commitments: “We’ll be finalizing investment commitments by [specific date].”

- Kick-off Meeting: “Once funds are secured, we’ll host a kick-off meeting to detail the immediate action items and address any investor queries.”

- Regular Updates: “Investors will receive quarterly updates on property performance, financials, and any significant developments.”

13. Q&A

While this isn’t a slide filled with content, it’s a pivotal part of your presentation. Here’s how you can structure and prepare for it:

- Anticipate Questions: Before the presentation, list potential questions investors might ask and prepare concise, data-backed answers. Common questions might include:

- “How did you arrive at your property valuations?”

- “What’s your contingency plan if renovations go over budget?”

- “How do you handle tenant disputes or vacancies?”

- “Are there any competing properties or developments in the area?”

- Engage Actively: Encourage investors to ask questions, and answer them confidently. If you don’t have an immediate answer, it’s okay to say, “I’ll look into that and get back to you.”

14. Thank You/Contact Information

- Gratitude: “We sincerely appreciate your time and consideration. Your trust and investment will play a pivotal role in the success of this venture.”

- Primary Contact:

- “For further inquiries or detailed discussions, please reach out to [Your Name], [Your Position].”

- Email: “[Your Email Address]”

- Phone: “[Your Contact Number]”

- Website: “For more information about our projects and team, visit [Your Company’s Website].”

Last Words

Here’s the thing: everyone’s chasing ROI, but not everyone knows where to find it. Your pitch isn’t just about numbers; it’s about connecting the dots—why this investment, why you, and why now.

Apartment investing is about creating value, not just cash flow. It’s about showing investors how they’ll benefit—whether it’s steady returns, portfolio diversification, or bragging rights at the next dinner party. And you? You’re the one who can make it happen.

Now that you’ve got the tools, it’s time to take the stage, show your investors the future you’re building, and invite them to be a part of it. Remember, they’re not just buying into a property—they’re buying into you. So, pitch boldly, confidently, and with purpose. Let’s close that deal.

You got this.

But if you don’t got it:

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

If you want to really dive into the world of pitch decks, check out our complete collection of pitch deck templates.

Related Real Estate Pitch Deck Templates

Check out our massive directory of real estate pitch deck templates. Some of them:

12 Slide Land Development Pitch Deck Template

12 Slide 59 Unit Luxury Hotel And Spa Pitch Deck Template

5 Step Guide To Build an Investment Fund Pitch Deck

5 Step Guide To Build an Investment Fund Pitch Deck Author: ViktorInvestment Fund Pitch Deck…

14 Slide Home Services Platform Pitch Deck Template | Google Slides

Hey there, homeowners. Let’s be honest—getting someone to fix that leaky faucet or deep-clean your…

Blueprint for Success: The 13 Slide Pitch Deck Israeli Real Estate Startups Are Using to Secure Funding | Google Slides

So, you’ve got your sights set on the booming Israel real estate market, but investors…

13 Slide Conundrum House Pitch Deck Template

So, you’ve got this brilliant idea for an immersive neighborhood adventure, but no one seems…

12 Slide Rooming House Pitch Deck Template | Google Slides

Ever walked into a rooming house and thought, “I could make this place a goldmine”?…

12 Slide Vacation Rental Pitch Deck | Google Slides

Picture this: you’re sipping your favorite drink, feet kicked up, staring out at a serene…

12 Slide Pitch Deck for Real Estate Tech: Sell Investors Faster Than You Sell Vacant Apartments | Google Slides

Let’s be honest—managing real estate properties today can feel like juggling flaming torches while blindfolded….

12 Slide Real Estate Shopify Pitch Deck Template:

You’ve got the vision. You see a future where real estate brokerages run smoothly, online,…

12 Slide Raw Land Development Real Estate Fund Pitch Deck Template

You’ve got your eyes set on raw land development, but let’s be honest—it’s not the…

16 Slide Shopping Center Funding Pitch Deck Template

You’ve spotted the perfect location for Louisville’s next iconic shopping center. You can already picture…

17 Slide Mixed Real Estate Pitch Deck Template That Closes Every Time

Ever walked past a seemingly ordinary building and thought, “This place has potential”? Well, you’re…

17 Slide Multi-Family Pitch Deck Template

You’ve found the perfect 200-unit multifamily property that’s just begging to be added to your…

14 Slides Real Estate Pitch Deck Template

Let’s dive straight into what sets your real estate development company apart. You’re here because…

17 Slide Austin Real Estate Investment Pitch Deck

So, you’ve got your eye on a prime land development opportunity in one of the…

12 Slide Hotel Development Pitch Deck Template

Alright, let’s get straight to it. You’re about to introduce something truly special—your hotel, the…

16 Slide Land Pitch Deck Template

Alright, let’s keep it straightforward and impactful: You’re on the brink of something big—really big….

Real Estate Training Course Pitch Deck Template

Let’s get straight to the point: You’re ready to dive into the multifamily real estate…

12 Slide Real Estate Cyprus Pitch Deck Template

So, you’ve got your sights set on the Cyprus real estate market—smart move. Whether it’s…

Looking for a step by step guide to build a real estate pitch deck?

Check out our in-depth real estate pitch deck guide. I’m a real estate pitch deck expert that can help you develop a deck for your project. Handsoff.

Check out some of the essential 101 guides:

The Role of Emotional Storytelling in Pitch Decks

Why Color Psychology in Pitch Decks Matters More Than You Think

This is the ideal pitch deck length + exact slides Author: ViktorPitch Deck Expert. Ex…

How to Design a Visually Stunning Investor Pitch Deck + Template

This is the ideal pitch deck length + exact slides

This is the ideal pitch deck length + exact slides Author: ViktorPitch Deck Expert. Ex…

Mastering the Financial Projections Slide: Turning First Impressions into Lasting Opportunities

You’re convinced your startup is the next big thing, but somehow, your pitch keeps landing…

Creating an Impactful Traction Slide for Your Investor Pitch Deck: A Startup Guide

You’ve got the next unicorn startup brewing, but here’s the harsh reality: your traction slide…