You’ve got a killer idea that could revolutionize the market, but here’s the rub: no one’s biting.

It’s not your idea that’s the problem—it’s your pitch deck. Yep, that trusty slideshow isn’t cutting it. But don’t worry, I’m here to guide you through this.

I’m Viktor, a pitch deck expert, and a presentation expert. Over the past 13 years, I’ve helped businesses secure millions of $ in funding thanks to my approach and I’m sharing it here in this pitch deck guide.

We’ll dive into why hiring a pitch deck expert is a smart move and how it can turn your funding dreams into reality.

Book a free personalized pitch deck consultation and save over 20 hours of your time.

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

Definition of a Pitch Deck Expert or Pitch Deck Consultant

A pitch deck expert is a professional with specialized skills in creating and optimizing pitch decks to attract investors and secure funding.

These experts bring a deep understanding of design principles, strategic positioning, narrative structure, and investor psychology to craft presentations that effectively communicate a startup’s value proposition.

Their role is multifaceted, encompassing elements of content creation, visual design, and strategic storytelling.

Skills and Expertise

- Design Proficiency: Pitch deck experts are adept at creating visually compelling slides that capture and maintain investor attention. They use design tools like PowerPoint, Keynote, Canva, and Figma to produce professional-quality presentations.

- Narrative Crafting: A key part of a pitch deck expert’s role is to build a coherent and compelling narrative. They know how to structure the presentation to tell a story that highlights the startup’s journey, market opportunity, and future potential. Storytelling is crucial in making the pitch memorable and emotionally engaging, which can significantly influence investor decisions.

- Market and Financial Analysis: Pitch deck experts also bring a strong understanding of market trends and financial modeling. They can integrate relevant data and projections to demonstrate the viability and scalability of the business. According to CB Insights, one of the top reasons startups fail is due to the lack of market need (42%), underscoring the importance of clearly showcasing market demand and growth potential in the pitch deck.

- Customization and Audience Tailoring: Different investors have different priorities, and pitch deck experts excel at tailoring the presentation to suit the specific audience. Experts highlight that customized pitch decks are more effective because they address the unique interests and concerns of each investor group, thereby increasing the likelihood of securing funding.

Why Pitch Deck Experts Are Valuable

- Professional Quality and Appeal: Professional pitch deck experts ensure that the presentation is not only informative but also visually appealing. This is critical because a well-designed pitch deck can significantly enhance investor engagement. Research indicates that pitch decks created with professional design assistance have a 50% higher chance of securing investment compared to those created without expert help.

- Time Efficiency: Crafting a high-quality pitch deck is a time-consuming process that requires careful attention to detail. By hiring a pitch deck expert, startup founders can save valuable time and focus on other critical aspects of their business. MentorCruise notes that working with a pitch deck expert can streamline the creation process, making it more efficient and less time-intensive.

- Higher Success Rates: The ultimate goal of a pitch deck is to secure funding. Statistics show that professionally created pitch decks are more successful in attracting investment. According to experts, startups that use pitch deck experts are more likely to secure meetings with investors and receive funding offers. This increased success rate can be attributed to the expert’s ability to craft a persuasive narrative and present the business opportunity in the best possible light.

Skills and Experience a Pitch Deck Expert Brings to the Table

A pitch deck expert brings a comprehensive set of skills and experience that are crucial for crafting a compelling and effective presentation. Their expertise spans several key areas, ensuring that your pitch deck not only captures attention but also clearly communicates your business’s value proposition. Here’s a detailed look at the skills and experience they offer, supported by current market research and authoritative reports.

Design Proficiency

Visual Design Expertise: Pitch deck experts are skilled in creating visually appealing slides that enhance the overall presentation. They understand the principles of good design, including the use of color, typography, layout, and imagery.

Use of Advanced Tools: Professionals use advanced design tools like Adobe Creative Suite, Figma, and Canva to produce high-quality visuals. These tools enable them to create custom graphics, charts, and infographics that make complex information more digestible. The rise of digital tools has democratized design, allowing pitch deck experts to create sophisticated presentations more efficiently and effectively.

Content Creation and Narrative Building

Storytelling Skills: A compelling narrative is at the heart of a successful pitch deck. Pitch deck experts are adept at crafting stories that resonate with investors. They structure the presentation to highlight the problem your business solves, the solution you offer, and the impact you aim to achieve.

Clarity and Focus: Experts know how to distill complex ideas into clear, concise messages. They focus on one key message per slide, avoiding information overload that can overwhelm and disengage investors. BaseTemplates emphasizes the importance of simplicity and clarity, as a cluttered deck can dilute the overall impact of the presentation.

Market and Financial Analysis

Market Research: Pitch deck experts conduct thorough market research to back up your claims with data. They analyze market trends, customer demographics, and competitive landscapes to provide a comprehensive view of your business environment. This data-driven approach is essential for convincing investors of the viability and scalability of your business.

Financial Projections and Analysis: Financial acumen is another critical skill that pitch deck experts bring to the table. They create realistic financial projections that showcase your business’s growth potential and revenue streams. These projections include key metrics such as customer acquisition cost, lifetime value, and break-even analysis.

Customization and Audience Tailoring

Audience-Specific Customization: Different investors have different priorities. Pitch deck experts customize the content to align with the specific interests of each audience. For example, venture capitalists may focus more on scalability and market size, while angel investors might be more interested in the founding team’s background and the innovation behind the product.

Feedback Incorporation: Experts also gather and incorporate feedback from initial presentations to refine the deck further. This iterative process ensures that the final product addresses all potential investor concerns and presents the business in the best possible light. MentorCruise suggests that ongoing revisions and refinements based on feedback can significantly enhance the quality and effectiveness of the pitch.

Project Management and Efficiency

Efficient Workflow Management: Creating a pitch deck is a time-intensive process that requires careful planning and execution. Pitch deck experts manage the entire workflow, from initial concept to final delivery, ensuring that the project stays on track and meets deadlines. This allows startup founders to focus on other critical aspects of their business.

Collaboration and Communication: Effective communication and collaboration with the founding team are essential for creating a pitch deck that truly reflects the business’s vision and goals. Pitch deck experts facilitate this collaboration, ensuring that all stakeholders are aligned and that the final presentation accurately represents the startup’s potential.

How an Expert Crafts a Compelling Story to Capture Investor Interest

Crafting a compelling story in a pitch deck is both an art and a science. An expert leverages their experience and skills to weave a narrative that not only presents the facts but also resonates emotionally with investors. Here’s how they do it, supported by current market research and authoritative reports on trends and challenges.

Understanding the Audience

Investor Persona Analysis: Experts begin by understanding their audience. They analyze the investor’s persona, including their interests, previous investments, and what motivates them. Tailoring the pitch to the specific interests of investors can significantly increase the likelihood of securing funding. This personalization helps in addressing the specific concerns and aspirations of potential investors, making the story more relevant and engaging.

Market Research: Experts conduct thorough market research to understand the industry landscape, target audience, and competitive environment. According to CB Insights, 42% of startups fail due to a lack of market need, highlighting the importance of clearly demonstrating market demand. This research forms the foundation of the narrative, ensuring that the story is grounded in reality and backed by data.

Structuring the Narrative

Problem-Solution Framework: A compelling story often follows a problem-solution framework. This involves clearly defining a significant problem and presenting the startup’s innovative solution.

Narrative Arc: Experts structure the pitch deck with a clear narrative arc that includes a beginning, middle, and end. The beginning sets the stage by introducing the problem, the middle builds up the solution and its impact, and the end presents a vision for the future. This arc helps in maintaining a logical flow and keeping the audience engaged.

Crafting Key Elements

Emotional Engagement: To create an emotional connection, experts incorporate personal stories, testimonials, and real-life examples. According to experts, an emotional connection is crucial for making the pitch memorable and engaging. By sharing stories of how the problem affects real people and how the solution has made a difference, experts humanize the startup and make it more relatable.

Visual Storytelling: Visuals play a critical role in storytelling. Experts use high-quality images, infographics, and videos to enhance the narrative and convey complex information simply and effectively. Research suggests that visual aids can help break down complex data and maintain investor interest, making the overall narrative more compelling.

Highlighting the Team: Experts know that investors often invest in teams as much as in ideas. They highlight the founding team’s experience, expertise, and passion, presenting them as the right people to execute the vision. Expert reports that pitches emphasizing strong, experienced teams are more likely to secure funding. Personal anecdotes and backgrounds of team members can add depth to the narrative and build trust with investors.

Addressing Concerns and Building Credibility

Preemptively Addressing Objections: Experts anticipate potential investor concerns and address them within the narrative. This proactive approach builds confidence and reduces objections. MentorCruise notes that addressing concerns upfront can significantly enhance the credibility of the pitch and increase the likelihood of investment.

Data-Driven Validation: Incorporating data and market validation is crucial for building credibility. Experts use market research, customer testimonials, and financial projections to support their claims and demonstrate the startup’s potential.

Houston Do You Copy?

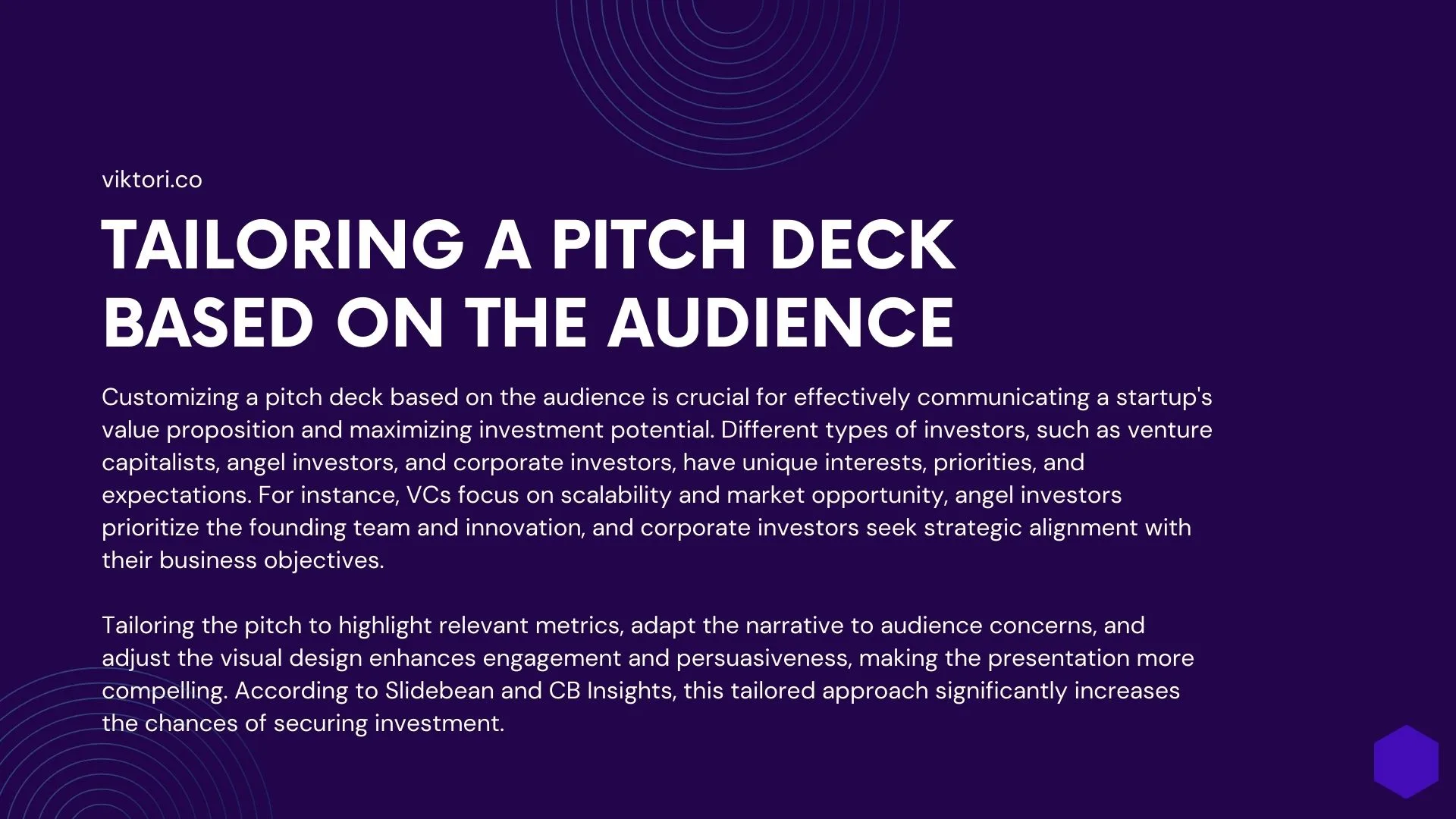

Customization of a pitch deck based on the audience is crucial for effectively communicating the startup’s value proposition and maximizing the chances of securing investment. Different types of investors have varying interests, priorities, and expectations. Tailoring the pitch to align with these factors can make the presentation more relevant, engaging, and persuasive.

Here’s a detailed exploration of why customization is essential, supported by current market research and authoritative reports on trends and challenges.

Understanding Different Investor Types

Venture Capitalists (VCs)Venture capitalists typically look for startups with high growth potential and scalable business models. They are interested in market size, competitive advantage, and financial projections.

Customizing the pitch for VCs involves highlighting these aspects and demonstrating how the startup can achieve significant returns on investment. According to a report by CB Insights, VCs are particularly focused on scalability and market opportunity, which are often decisive factors in their investment decisions.

Angel Investors: Angel investors often prioritize the founding team and the innovation behind the product. They may be more willing to take risks on early-stage startups if they believe in the team’s vision and capabilities.

Customizing the pitch for angel investors involves emphasizing the team’s background, expertise, and passion, as well as the unique value proposition of the product. An expert notes that pitches tailored to highlight the team’s strengths and innovative solutions are more likely to attract angel investors.

Corporate Investors: Corporate investors may have strategic interests aligned with their business objectives. They might look for startups that complement their existing products or services, or those that offer new technological advancements.

Customizing the pitch for corporate investors involves aligning the startup’s vision and value proposition with the strategic goals of the corporation. An expert emphasizes the importance of demonstrating synergy between the startup’s offerings and the corporate investor’s strategic interests.

Tailoring the Content

Focus on Relevant Metrics: Different investors focus on different metrics. VCs might prioritize metrics such as customer acquisition cost (CAC) and lifetime value (LTV), while angel investors might be more interested in product milestones and initial traction. Customizing the pitch involves including the most relevant metrics for the target audience. BaseTemplates highlights that focusing on the right metrics can make the pitch more compelling and easier for investors to evaluate the startup’s potential.

Adapting the Narrative: The narrative of the pitch should be adapted to resonate with the specific interests and concerns of the audience. For example, if pitching to a group of environmentally conscious investors, the narrative should emphasize the startup’s sustainability efforts and environmental impact. Research reports that pitches tailored to align with the values and interests of the audience are more likely to be successful.

Visual Design and Presentation Style: Customization also extends to the visual design and presentation style. For more formal investors, a sleek and professional design might be appropriate, while for more creative or tech-savvy investors, an innovative and modern design might be more effective. According to experts, tailoring the visual style to the audience can enhance engagement and make the pitch more memorable.

Pitch Deck Content Matrix for Specific Audiences

Here’s a detailed matrix table outlining what should be included in a pitch deck, tailored for different types of investors: Venture Capitalists (VCs), Angel Investors, and Corporate Investors.

| Pitch Deck Section | Venture Capitalists (VCs) | Angel Investors | Corporate Investors |

|---|---|---|---|

| 1. Executive Summary | High-level overview with emphasis on market opportunity and scalability | Brief overview highlighting the innovation and team expertise | Overview focusing on strategic fit and potential synergies |

| 2. Problem Statement | Detailed description of a significant market problem | Relatable problem with real-life examples | Problem relevant to the corporate’s market or strategic interests |

| 3. Solution | Innovative solution with competitive advantages | Unique, groundbreaking solution | Solution that complements or enhances the corporate’s existing offerings |

| 4. Market Opportunity | Extensive market research, total addressable market (TAM), and growth projections | Market potential with focus on initial traction and early adopters | Market data showing how the solution fits within the corporate’s target market |

| 5. Business Model | Scalable and repeatable revenue model with detailed projections | Clear revenue streams with initial financial performance | Business model showing strategic alignment and potential integration points |

| 6. Traction and Milestones | Significant milestones achieved, key metrics, and growth indicators | Early traction, user feedback, and pilot results | Demonstrated success and milestones that align with corporate goals |

| 7. Competitive Analysis | In-depth analysis of competitors, market positioning, and unique value proposition | High-level overview of competitors with focus on differentiation | Competitive landscape with focus on strategic advantages and potential collaborations |

| 8. Go-to-Market Strategy | Detailed go-to-market plan, customer acquisition cost (CAC), and lifetime value (LTV) | Initial marketing and sales strategy with focus on community building | Go-to-market plan that highlights potential partnerships and corporate synergies |

| 9. Financial Projections | Detailed financial projections, unit economics, and key assumptions | Financial overview with focus on break-even analysis and profitability | Financial projections showing potential ROI and strategic impact |

| 10. Team | Experienced team with relevant backgrounds and track record of success | Passionate and committed team with relevant expertise | Team’s experience and expertise aligning with corporate strategic interests |

| 11. Funding Requirements | Specific funding needs, use of funds, and future funding plans | Clear funding ask with detailed use of funds | Funding requirements aligned with potential strategic investments or partnerships |

| 12. Exit Strategy | Potential exit opportunities, target acquirers, and expected ROI | High-level exit strategy with potential acquisition targets | Exit strategy focusing on strategic fit with potential corporate acquisitions |

Key Points for Different Audiences

Venture Capitalists (VCs)

- Focus on Scalability: VCs are looking for startups that can grow rapidly and capture significant market share.

- Detailed Financials: They need to see comprehensive financial projections, including CAC and LTV.

- Competitive Edge: Highlight what makes your solution unique and how it stands out in the competitive landscape.

Angel Investors

- Innovative Solutions: Angels are often attracted to groundbreaking ideas and passionate teams.

- Early Traction: Show initial results and user feedback to prove that there’s a demand for your solution.

- Personal Touch: Angels often appreciate a more personal story about the founders and the inspiration behind the startup.

Corporate Investors

- Strategic Fit: Corporates look for how your startup can complement or enhance their existing offerings.

- Synergy Potential: Demonstrate how a partnership can create mutual benefits.

- Market Relevance: Ensure that your market data aligns with the corporate’s strategic goals and target markets.

Market Research and Trends

Increasing Demand for Personalization: There is a growing trend towards personalization in investor pitches. As the startup ecosystem becomes more competitive, the ability to tailor a pitch to specific investor interests and preferences can be a significant differentiator. According to a report by MentorCruise, startups that personalize their pitches for different investor audiences tend to have higher success rates in securing funding.

Challenges in Customization: One of the challenges in customizing a pitch deck is the need for deep research and understanding of the target audience. This requires time and effort, but the payoff can be substantial. Startups need to invest in understanding the unique needs and priorities of different investors to effectively tailor their pitches. BaseTemplates advises that this effort is well worth it, as a customized pitch is more likely to resonate and result in investment.

In summary, customizing a pitch deck based on the audience is essential for effectively communicating the startup’s value proposition and increasing the chances of securing investment. By understanding different investor types, focusing on relevant metrics, adapting the narrative, and tailoring the visual design, startups can create pitches that are more engaging, persuasive, and successful.

How Experts Tailor the Pitch to Resonate with Different Types of Investors

Tailoring a pitch deck to resonate with different types of investors is a strategic process that requires a deep understanding of investor preferences, priorities, and decision-making criteria. Experts customize the content, narrative, and design of the pitch to align with the specific needs and expectations of various investor types. Here’s how they do it, supported by statistics and insights from current market research and authoritative reports.

Understanding Investor Profiles

Venture Capitalists (VCs): Venture capitalists typically look for high-growth potential and scalability. They focus on market size, competitive advantage, and financial projections. Customizing a pitch for VCs involves highlighting these aspects prominently. According to CB Insights, scalability and market opportunity are decisive factors for VCs, which means the pitch should clearly demonstrate how the startup can achieve significant growth and capture a large market share.

Angel Investors: Angel investors are often more focused on the founding team and the innovation behind the product. They are willing to take risks on early-stage startups if they believe in the team’s vision and capabilities. Customizing the pitch for angel investors involves emphasizing the team’s background, expertise, and passion, as well as the unique value proposition of the product.

Corporate Investors: Corporate investors usually have strategic interests that align with their business objectives. They might seek startups that complement their existing products or services or those that offer new technological advancements. Customizing the pitch for corporate investors involves aligning the startup’s vision and value proposition with the strategic goals of the corporation.

Customizing Content

Focus on Relevant Metrics: Experts tailor the pitch by focusing on metrics that are most relevant to the specific investor type. For VCs, this might include customer acquisition cost (CAC), lifetime value (LTV), and total addressable market (TAM). For angel investors, the focus might be on early traction, product development milestones, and market validation. BaseTemplates highlights that focusing on the right metrics can make the pitch more compelling and easier for investors to evaluate the startup’s potential.

Adapting the Narrative: The narrative of the pitch should be adapted to resonate with the specific interests and concerns of the audience. For instance, if pitching to impact investors, the narrative should emphasize the startup’s social and environmental impact. According to research, aligning the pitch’s narrative with the values and interests of the audience can significantly increase its effectiveness.

Visual Design and Presentation Style: Customization extends to the visual design and presentation style. For more formal investors, a sleek and professional design might be appropriate, while for creative or tech-savvy investors, an innovative and modern design might be more effective. Experts stress that tailoring the visual style to the audience can enhance engagement and make the pitch more memorable.

Incorporating Feedback and Iteration

Feedback Loop: Experts gather feedback from initial presentations and use it to refine the pitch further. This iterative process ensures that the final product addresses all potential investor concerns and presents the business in the best possible light. According to MentorCruise, ongoing revisions based on feedback can significantly enhance the quality and effectiveness of the pitch.

Real-Time Customization: During live presentations, experts are prepared to adapt the pitch in real-time based on investor reactions and questions. This agility demonstrates a deep understanding of the subject matter and an ability to engage dynamically with investors. BaseTemplates notes that being able to pivot and address concerns on the spot can build investor confidence and interest.

Focus On What You Do Best…And Leave The Rest For The Best?

Bad puns aside, creating a pitch deck is a comprehensive and intricate process that requires a significant investment of time and effort. From conducting market research to designing slides and refining the narrative, each step demands meticulous attention to detail.

Here’s a detailed exploration of why creating a pitch deck is time-consuming, supported by statistics and authoritative insights on current market trends and challenges.

Conducting Thorough Market Research

In-Depth Market Analysis: To create a compelling pitch deck, extensive market research is necessary to understand the industry landscape, target audience, competitive environment, and potential market opportunities. This research forms the foundation of the pitch deck, ensuring that all claims are backed by solid data. According to a report by CB Insights, 42% of startups fail due to a lack of market need, emphasizing the importance of demonstrating clear market demand. Conducting this research can take several weeks, depending on the complexity of the market and the availability of data.

Gathering Supporting Data: Collecting relevant data to support the business case is a crucial part of the process. This includes sourcing industry reports, competitor analyses, customer feedback, and financial projections. Effective data gathering and analysis are essential for creating a pitch that resonates with investors and demonstrates the startup’s potential.

Developing the Narrative and Content

Crafting a Compelling Story: Building a compelling narrative that captures the essence of the startup’s mission and vision is a critical yet time-consuming task. This involves structuring the presentation to highlight the problem, solution, market opportunity, business model, and team.

Tailoring Content to the Audience: Customizing the content to resonate with different types of investors further adds to the time required. Each investor group, whether VCs, angel investors, or corporate investors, has different priorities and expectations. Focusing on the right metrics and aligning the narrative with investor interests can make the pitch more compelling but requires additional time for research and adaptation.

Pitch Deck Designing

Visual Design and Layout: Creating a visually appealing pitch deck involves designing each slide with care. This includes selecting the right color schemes, fonts, images, and layouts to ensure consistency and professionalism. According to experts, a well-designed pitch deck significantly improves investor engagement. The design phase often involves multiple revisions to achieve the desired visual impact, which can be time-intensive.

Data Visualization: Presenting complex data in an easily understandable format is another challenge. This requires creating charts, graphs, and infographics that effectively communicate key information. BaseTemplates emphasizes that visual aids are crucial for breaking down complex data and maintaining investor interest. Designing these visual elements takes time and expertise.

Refining and Polishing

Incorporating Feedback: After initial drafts are created, the pitch deck goes through several rounds of feedback and revisions. This iterative process ensures that the final product addresses all potential investor concerns and presents the business in the best possible light. MentorCruise suggests that incorporating feedback from advisors, mentors, and potential investors can significantly enhance the quality of the pitch, but it also extends the timeline.

Final Proofreading and Testing: Ensuring that the pitch deck is free of errors and flows smoothly is the final step. This involves proofreading the content, testing the presentation for coherence and impact, and making final adjustments. According to research, a polished and error-free pitch deck reflects professionalism and attention to detail, which can influence investor perceptions positively.

How Hiring an Expert Can Save Time and Allow Founders to Focus on Other Critical Tasks

For startup founders who are already juggling multiple responsibilities, hiring a pitch deck expert can be a game-changer. Here’s how bringing in a professional can save time and allow founders to focus on other critical tasks, supported by statistics and authoritative insights from current market research and reports.

Efficient Workflow and Expertise

Streamlined Process: Pitch deck experts bring a streamlined process to the table. They have established methodologies and templates that allow them to quickly gather necessary information and structure it effectively. According to MentorCruise, working with an expert can significantly reduce the time spent on the initial planning and organization stages of pitch deck creation.

Specialized Skills: Experts possess specialized skills in design, storytelling, and financial modeling that most founders may not have. Experts emphasize that leveraging these skills ensures the pitch deck is not only high quality but also tailored to investor expectations. This specialization means that tasks that might take founders weeks to complete can be done more efficiently by an expert.

Data and Market Insights: Professionals have access to up-to-date market data and insights, allowing them to incorporate the latest trends and statistics into the pitch deck. This not only saves time on research but also ensures the pitch is relevant and compelling. According to CB Insights, incorporating current market trends is crucial for demonstrating the startup’s awareness of its industry landscape and potential market opportunities.

Focus on Core Business Activities

Product Development: One of the primary benefits of hiring an expert is that it allows founders to focus on developing their product or service. According to research, startups that prioritize product development and customer acquisition tend to perform better in the long run. By delegating the pitch deck creation to an expert, founders can concentrate on refining their offerings and building a strong customer base.

Fundraising and Networking: Founders often need to spend considerable time networking and building relationships with potential investors. By outsourcing the pitch deck creation, they can allocate more time to attending industry events, meeting with investors, and refining their pitch delivery.

Operational Management: Managing the day-to-day operations of a startup is another critical task that demands the founder’s attention. From overseeing staff to managing finances and ensuring smooth operations, these tasks are essential for the business’s survival and growth. MentorCruise highlights that effective operational management is crucial for maintaining business stability and scaling operations.

Success Rates of Professionally Created Startup Pitch Decks

Professionally created pitch decks have a higher success rate in attracting investment compared to those created without expert assistance. This can be attributed to the enhanced quality, clarity, and engagement that professional design and content bring to the table. Here are some statistics and insights from current market research and authoritative reports on the trends and challenges faced by startups in securing funding.

Higher Success Rates with Professional Design

DocSend Analysis: DocSend’s analysis of pitch decks reveals that professionally designed presentations tend to keep investors engaged for longer periods. The average time spent by investors on professionally designed pitch decks is higher, which increases the likelihood of securing follow-up meetings and investments. This additional engagement time is critical because investors typically spend less than 4 minutes on each pitch deck.

Enhanced Investor Engagement

Improved Readability and Comprehension: Professionally created pitch decks use effective data visualization techniques such as charts, graphs, and infographics to present complex information in a digestible format.

Emotional Connection and Storytelling: Effective storytelling is a hallmark of professionally created pitch decks. An expert notes that a compelling narrative can create an emotional connection with investors, making the pitch more memorable and engaging. This emotional engagement can be a decisive factor in securing funding, as it helps investors connect with the startup’s vision and potential impact.

Credibility and Professionalism

Building Trust with Investors: A polished and professional pitch deck signals to investors that the startup is serious and capable of delivering quality. This perception of professionalism builds trust and credibility, which are crucial for convincing investors to commit funds. Research highlights that investors are more inclined to engage with startups that present themselves professionally, as it reflects their ability to execute their business plan effectively.

Market Relevance and Adaptation: Professionals keep pitch decks updated with the latest market trends and data, ensuring that the presentation is relevant and compelling. According to CB Insights, demonstrating awareness of current market trends and adapting the pitch to reflect these insights is essential for attracting investor interest.

How Much Does It Cost To Build An Investor Pitch Deck?

This is where a-lot of founders decide they’ll do it themselves.

And this is also where founders find out that they’ve spent 2 weeks away from their business and family and gotten nowhere.

The first question you should ask yourself is: How much is 1 hour of your time worth?

Then, multiply that by 50-100 hours (rough estimate of the time needed for a non expert to build a solid deck) and you’ll find out whether you should get an expert to do it or not.

Actually, let’s build a quick scenario.

DIY: The Hidden Costs

Time Investment: Creating a compelling pitch deck is time-consuming. As a founder, your time is incredibly valuable and better spent on core activities like product development, customer acquisition, and strategic planning. On average, founders spend around 50-100 hours creating a pitch deck from scratch. If we value your time at $100 per hour, that’s $5,000 to $10,000 just in time investment.

Learning Curve: Unless you’re already a design and storytelling guru, there’s a significant learning curve. You’ll need to spend additional hours learning design principles, understanding what investors look for, and iterating on your content. This learning curve can add another 20-30 hours to your timeline, equating to an additional $2,000 to $3,000.

Software Costs: You’ll also need to invest in design software. Adobe Creative Suite, for example, costs around $600 annually. If you opt for more user-friendly tools like Canva Pro, it’s about $120 per year. These costs might seem minor but add up quickly.

Quality Risks: Without professional experience, the quality of your pitch deck might not meet investor standards. Poor design or a lackluster narrative can lead to missed funding opportunities, costing you potential investments that could range from thousands to millions of dollars.

Total DIY Costs: $7,720 – $13,720 (time, learning, software, and potential missed opportunities)

Hiring a Pitch Deck Expert: The Smart Investment

Professional Fees: Hiring a pitch deck expert typically costs between $1,500 and $4,000 for comprehensive services. This includes design, content creation, market research, and strategic storytelling. High-end services can go up to $20,000, but for most startups, the mid-range services are more than sufficient.

Time Savings: By outsourcing this task, you free up 70-130 hours (considering both creation and learning time) to focus on high-impact activities. This translates to a significant opportunity cost saving, valued at $7,000 to $16,000, using our previous hourly rate.

Quality and Impact: Experts bring a polished, professional touch that can dramatically increase your chances of securing funding. According to research, professionally designed pitch decks are 50% more likely to secure investment compared to DIY versions. This boost in quality can lead to higher funding rounds and better investor terms, potentially increasing your company’s valuation by hundreds of thousands of dollars.

Avoiding Common Pitfalls: Experts help you avoid common mistakes such as overloading slides with information, lack of narrative flow, and poor visual design. This not only makes your pitch more compelling but also ensures it aligns with what investors expect and appreciate.

Total Expert Costs: $1,500 – $4,000 (plus the opportunity cost savings and increased funding potential)

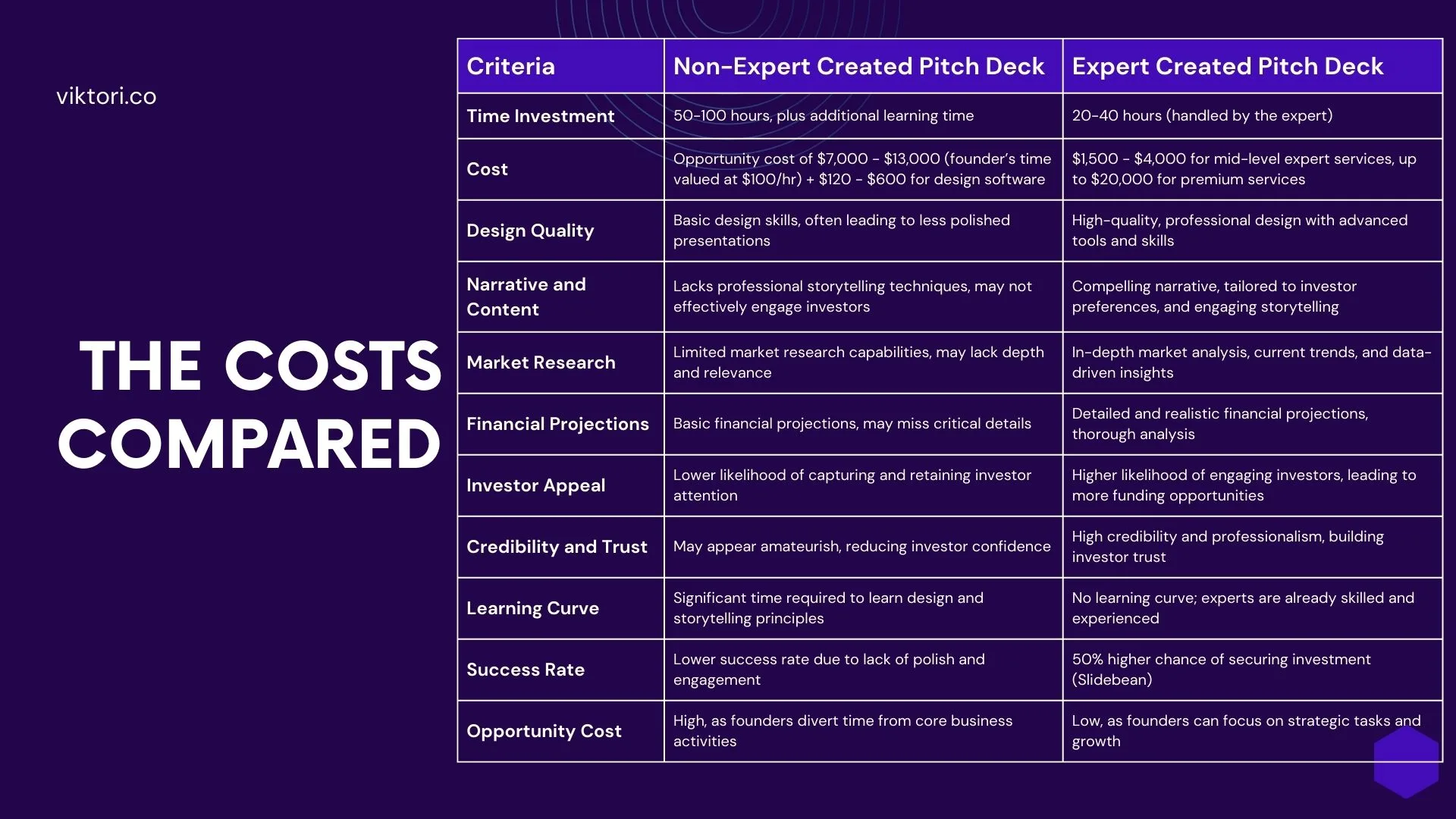

Comparison Table: Non-Expert vs. Expert Created Pitch Deck

| Criteria | Non-Expert Created Pitch Deck | Expert Created Pitch Deck |

|---|---|---|

| Time Investment | 50-100 hours, plus additional learning time | 20-40 hours (handled by the expert) |

| Cost | Opportunity cost of $7,000 – $13,000 (founder’s time valued at $100/hr) + $120 – $600 for design software | $1,500 – $4,000 for mid-level expert services, up to $20,000 for premium services |

| Design Quality | Basic design skills, often leading to less polished presentations | High-quality, professional design with advanced tools and skills |

| Narrative and Content | Lacks professional storytelling techniques, may not effectively engage investors | Compelling narrative, tailored to investor preferences, and engaging storytelling |

| Market Research | Limited market research capabilities, may lack depth and relevance | In-depth market analysis, current trends, and data-driven insights |

| Financial Projections | Basic financial projections, may miss critical details | Detailed and realistic financial projections, thorough analysis |

| Investor Appeal | Lower likelihood of capturing and retaining investor attention | Higher likelihood of engaging investors, leading to more funding opportunities |

| Credibility and Trust | May appear amateurish, reducing investor confidence | High credibility and professionalism, building investor trust |

| Learning Curve | Significant time required to learn design and storytelling principles | No learning curve; experts are already skilled and experienced |

| Success Rate | Lower success rate due to lack of polish and engagement | 50% higher chance of securing investment |

| Opportunity Cost | High, as founders divert time from core business activities | Low, as founders can focus on strategic tasks and growth |

Challenges and Considerations

Budget Constraints: One of the primary challenges for startups is budget constraints. Allocating funds for professional pitch deck services can be difficult, especially for early-stage startups with limited resources. However, the potential benefits of securing investment can outweigh the initial costs. BaseTemplates advises startups to consider the long-term value and potential ROI when deciding on their budget for pitch deck creation.

Finding the Right Expert: Another challenge is finding the right pitch deck expert who understands the specific needs and goals of the startup. It’s essential to review the expert’s portfolio, seek testimonials, and potentially conduct interviews to ensure a good fit.

Balancing Cost and Quality: Startups must balance cost and quality when choosing pitch deck services. While it may be tempting to opt for lower-cost options, the potential downside is a less polished and compelling presentation, which can negatively impact investor interest.

Potential Returns on Investment

Increased Likelihood of Securing Funding: Professionally designed pitch decks are significantly more likely to secure investment. According to research, startups that utilize professional design services have a 50% higher chance of obtaining funding compared to those that do not. This increased likelihood of securing investment can lead to substantial financial returns, far exceeding the initial cost of hiring an expert.

Higher Valuations: A well-crafted pitch deck can help startups achieve higher valuations during funding rounds. By clearly demonstrating market potential, scalability, and a solid business model, startups can attract more substantial investments at better terms. CB Insights reports that investors are more likely to invest in startups that present well-researched and professionally designed pitch decks, which can lead to higher valuations.

Time Savings and Opportunity Costs: Hiring an expert saves founders significant time, allowing them to focus on other critical aspects of their business such as product development, customer acquisition, and operational management. According to MentorCruise, delegating pitch deck creation to professionals can reduce the time spent on this task by up to 50%. This time savings translates into opportunity costs, as founders can engage in activities that directly contribute to business growth and revenue generation.

Enhancing Professionalism and Credibility

Investor Perception: A polished, professional pitch deck enhances the startup’s credibility and signals to investors that the founders are serious and capable of delivering quality work.

Emotional Engagement and Memorability: Effective storytelling and visual appeal can create an emotional connection with investors, making the pitch more memorable and engaging. Research emphasizes that a compelling narrative can significantly increase the likelihood of securing follow-up meetings and investment.

Real-World Examples

Successful Case Studies: High-profile startups like Airbnb and Uber attribute part of their fundraising success to professionally created pitch decks. These decks effectively communicated their value propositions, market opportunities, and business models, helping them secure substantial early investments.

For more case studies check out how my clients benefited from working with me:

Final Thoughts

Investing in a pitch deck expert can be one of the smartest decisions a startup can make when seeking to secure funding. Here’s why, supported by statistics and insights from current market research and authoritative reports on the trends and challenges in the startup ecosystem.

Enhancing Professionalism and Credibility

First Impressions Matter: A professionally designed pitch deck creates a strong first impression. Investors are more likely to take a startup seriously if the pitch deck is polished and visually appealing. According to research, investors are 50% more likely to invest in startups with professionally designed pitch decks, emphasizing the importance of professionalism in fundraising efforts.

Building Trust: A high-quality pitch deck signals to investors that the startup is detail-oriented and committed to excellence. Experts note that this level of professionalism builds trust and credibility, which are crucial for convincing investors to commit their resources.

Improving Engagement and Clarity

Visual Appeal: Effective use of design elements such as color schemes, typography, and infographics can significantly enhance the pitch deck’s visual appeal. DocSend reports that well-designed pitch decks hold investor attention for longer periods, increasing the likelihood of securing follow-up meetings.

Data Visualization: Professionals use data visualization techniques to present complex information in an easily understandable format. This helps investors quickly grasp key metrics and insights. BaseTemplates highlights that visual aids can simplify complex data and maintain investor interest, making the overall presentation more compelling.

Crafting a Compelling Narrative

Storytelling: Experts excel at weaving a cohesive and engaging narrative that highlights the startup’s mission, vision, and potential impact. Experts emphasize that a compelling story can create an emotional connection with investors, making the pitch more memorable and persuasive.

Tailored Content: By tailoring the pitch to the specific interests of different investor types (VCs, angel investors, corporate investors), experts ensure that the presentation resonates with the audience. CB Insights reports that demonstrating market need and scalability is crucial for attracting VC interest, while research notes that highlighting the team’s strengths and innovative solutions appeals more to angel investors.

Saving Time and Resources

Efficiency: Creating a high-quality pitch deck is a time-consuming process. By hiring an expert, startups can save valuable time that can be redirected to core business activities such as product development and customer acquisition. According to MentorCruise, working with a pitch deck expert can reduce the time spent on deck creation by up to 50%.

Focused Efforts: Outsourcing pitch deck creation allows founders to focus on other critical tasks, such as networking and operational management. This holistic approach ensures that all aspects of the startup are running smoothly, increasing the overall chances of success.

You got this.

But if you don’t got it:

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

If you want to really dive into the world of pitch decks, check out our complete collection of pitch deck guides, pitch deck outlines and pitch deck examples. Got a pressing issue? Check out our forum and post your questions there.